Biznesradar bez reklam? Sprawdź BR Plus

Komponenty indeksu WIG140

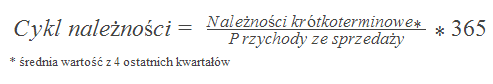

Wskaźniki aktywności: Cykl należności

Zobacz opis wskaźnika

- Cykl należności

Wskaźnik ten wskazuje, ile dni upływa od momentu sprzedaży do momentu otrzymania zapłaty (długość tzw. kredytu kupieckiego). Przy badaniu tego wskaźnika w skali roku (365 dni) jego wartość powinna się kształtować w przedziale od 37 do 52 dni.

źródło: Wikipedia, opr. wł.

źródło: Wikipedia, opr. wł.

| Profil | Raport | Cykl należności | r/r | k/k |

|---|---|---|---|---|

| ING (INGBSK) | 2025/Q3 | 4 246 | +1,41% | +1,38% |

| BNP (BNPPPL) | 2025/Q3 | 3 012 | -2,87% | +2,83% |

| MBK (MBANK) | 2025/Q3 | 2 945 | +9,03% | +3,70% |

| SPL (SANPL) | 2025/Q3 | 2 906 | +2,61% | +0,45% |

| ALR (ALIOR) | 2025/Q3 | 2 885 | +7,29% | +2,34% |

| PEO (PEKAO) | 2025/Q3 | 2 780 | +0,65% | +1,72% |

| MIL (MILLENNIUM) | 2025/Q3 | 2 660 | -5,41% | 0,00% |

| BHW (HANDLOWY) | 2025/Q3 | 2 635 | +14,71% | -1,05% |

| PKO (PKOBP) | 2025/Q3 | 2 533 | +0,88% | +1,69% |

| BOS | 2025/Q3 | 2 259 | -7,65% | -1,18% |

| SCP (SCPFL) | 2025/Q3 | 1 602 | -82,49% | -1,17% |

| PZU | 2025/Q3 | 1 369 | +8,22% | 0,00% |

| GRX (GREENX) | 2024/Q4 | 834 | +452,32% | |

| CTX (CAPTORTX) | 2025/Q3 | 538 | +187,70% | +33,17% |

| SVE (SNTVERSE) | 2025/Q3 | 213 | +45,89% | +23,12% |

| VOT (VOTUM) | 2025/Q3 | 176 | -23,14% | -6,38% |

| KGN (KOGENERA) | 2025/Q3 | 164 | +3,14% | -3,53% |

| CLC (COLUMBUS) | 2025/Q3 | 154 | +62,11% | +14,07% |

| MLS (MLSYSTEM) | 2025/Q3 | 137 | -10,46% | -3,52% |

| MRB (MIRBUD) | 2025/Q3 | 135 | +90,14% | +14,41% |

| ELT (ELEKTROTI) | 2025/Q3 | 128 | -2,29% | +4,07% |

| GEA (GRENEVIA) | 2025/Q3 | 127 | -5,93% | +3,25% |

| CLN (CLNPHARMA) | 2025/Q3 | 123 | +89,23% | +28,12% |

| ERB (ERBUD) | 2025/Q3 | 117 | -6,40% | +0,86% |

| CRI (CREOTECH) | 2025/Q3 | 115 | +5,50% | +59,72% |

| OND (ONDE) | 2025/Q3 | 114 | -11,63% | -0,87% |

| ARH (ARCHICOM) | 2025/Q3 | 110 | +42,86% | -5,17% |

| UNI (UNIBEP) | 2025/Q3 | 110 | +13,40% | +6,80% |

| ACP (ASSECOPOL) | 2025/Q3 | 107 | +5,94% | +5,94% |

| DAT (DATAWALK) | 2025/Q3 | 105 | -19,85% | +2,94% |

| RVU (RYVU) | 2025/Q3 | 105 | -21,05% | -8,70% |

| MLG (MLPGROUP) | 2025/Q3 | 104 | +40,54% | +1,96% |

| MSZ (MOSTALZAB) | 2025/Q3 | 104 | -0,95% | +0,97% |

| MDG (MEDICALG) | 2025/Q3 | 101 | +4,12% | -4,72% |

| WPL (WIRTUALNA) | 2025/Q3 | 101 | +44,29% | 0,00% |

| ASE (ASSECOSEE) | 2025/Q3 | 97 | -1,02% | +2,11% |

| MCI | 2025/Q3 | 97 | +3,19% | +18,29% |

| XTP (XTPL) | 2025/Q3 | 93 | -29,01% | -10,58% |

| PXM (POLIMEXMS) | 2025/Q3 | 93 | -43,29% | -21,19% |

| CIG (CIGAMES) | 2025/Q3 | 92 | +70,37% | -7,07% |

| PBX (PEKABEX) | 2025/Q3 | 91 | -19,47% | -2,15% |

| LBW (LUBAWA) | 2025/Q3 | 90 | +7,14% | +8,43% |

| VOX (VOXEL) | 2025/Q3 | 89 | +3,49% | +1,14% |

| AMB (AMBRA) | 2026/Q1 | 88 | -1,12% | 0,00% |

| SLV (SELVITA) | 2025/Q3 | 86 | -7,53% | 0,00% |

| BDX (BUDIMEX) | 2025/Q3 | 86 | +7,50% | +1,18% |

| BLO (BLOOBER) | 2025/Q3 | 86 | -4,44% | +2,38% |

| TOR (TORPOL) | 2025/Q3 | 86 | +4,88% | -2,27% |

| CPS (CYFRPLSAT) | 2025/Q3 | 83 | +6,41% | +2,47% |

| MCR | 2025/Q2 | 82 | -7,87% | -18,00% |

| WLT (WIELTON) | 2025/Q3 | 81 | +8,00% | 0,00% |

| ZEP (ZEPAK) | 2025/Q3 | 80 | -19,19% | -13,98% |

| ECH (ECHO) | 2025/Q3 | 77 | -14,44% | -33,62% |

| VGO (VIGOPHOTN) | 2025/Q3 | 77 | -49,67% | +2,67% |

| FTE (FORTE) | 2025/Q2 | 76 | -10,59% | -9,52% |

| FRO (FERRO) | 2025/Q3 | 76 | +4,11% | +1,33% |

| ALL (AILLERON) | 2025/Q3 | 74 | -2,63% | +4,23% |

| COG (COGNOR) | 2025/Q3 | 72 | +5,88% | +2,86% |

| MBR (MOBRUK) | 2025/Q3 | 72 | -16,28% | -5,26% |

| SEL (SELENAFM) | 2025/Q3 | 72 | -1,37% | 0,00% |

| MRC (MERCATOR) | 2025/Q3 | 70 | -9,09% | -4,11% |

| ENA (ENEA) | 2025/Q3 | 70 | -4,11% | 0,00% |

| STP (STALPROD) | 2025/Q3 | 69 | -6,76% | -2,82% |

| 11B (11BIT) | 2025/Q3 | 69 | +6,15% | +9,52% |

| GPW | 2025/Q3 | 69 | -6,76% | -5,48% |

| OPL (ORANGEPL) | 2025/Q3 | 68 | -4,23% | -1,45% |

| CDR (CDPROJEKT) | 2025/Q3 | 68 | +11,48% | -6,85% |

| SNT (SYNEKTIK) | 2025/Q4 | 67 | +34,00% | +6,35% |

| ACG (ACAUTOGAZ) | 2025/Q3 | 66 | +29,41% | +10,00% |

| TXT (TEXT) | 2025/Q2 | 65 | +27,45% | +10,17% |

| WWL (WAWEL) | 2025/Q3 | 64 | -3,03% | +1,59% |

| NWG (NEWAG) | 2025/Q3 | 63 | -7,35% | -14,86% |

| MAB (MABION) | 2025/Q3 | 63 | -7,35% | -19,23% |

| PLW (PLAYWAY) | 2025/Q3 | 62 | +1,64% | +3,33% |

| APT (APATOR) | 2025/Q3 | 61 | -7,58% | -1,61% |

| SNK (SANOK) | 2025/Q3 | 61 | 0,00% | -1,61% |

| DCR (DECORA) | 2025/Q3 | 60 | +1,69% | 0,00% |

| AGO (AGORA) | 2025/Q3 | 60 | +3,45% | -1,64% |

| CRJ (CREEPYJAR) | 2025/Q3 | 60 | -1,64% | -3,23% |

| AMC (AMICA) | 2025/Q3 | 59 | -9,23% | -3,28% |

| CMP (COMP) | 2025/Q3 | 58 | -9,38% | -6,45% |

| TOA (TOYA) | 2025/Q3 | 57 | 0,00% | -1,72% |

| KTY (KETY) | 2025/Q3 | 56 | -3,45% | 0,00% |

| ABS (ASSECOBS) | 2025/Q3 | 56 | +5,66% | +1,82% |

| AST (ASTARTA) | 2025/Q3 | 56 | +33,33% | +5,66% |

| CAR (INTERCARS) | 2025/Q3 | 55 | +3,77% | 0,00% |

| SKA (SNIEZKA) | 2025/Q3 | 54 | +3,85% | +3,85% |

| ATC (ARCTIC) | 2025/Q3 | 54 | +8,00% | 0,00% |

| SGN (SYGNITY) | 2025/Q3 | 54 | -5,26% | |

| LWB (BOGDANKA) | 2025/Q3 | 54 | +17,39% | +12,50% |

| BRS (BORYSZEW) | 2025/Q3 | 53 | 0,00% | -1,85% |

| NEU (NEUCA) | 2025/Q3 | 53 | +3,92% | +1,92% |

| ATT (GRUPAAZOTY) | 2025/Q3 | 52 | -3,70% | +4,00% |

| TEN (TSGAMES) | 2025/Q3 | 52 | -18,75% | -5,45% |

| PCR (PCCROKITA) | 2025/Q3 | 50 | +4,17% | 0,00% |

| TPE (TAURONPE) | 2025/Q3 | 47 | -6,00% | -4,08% |

| JSW | 2025/Q3 | 47 | -6,00% | -4,08% |

| BIO (BIOTON) | 2025/Q3 | 47 | -17,54% | +6,82% |

| HUG (HUUUGE) | 2025/Q3 | 43 | +2,38% | +2,38% |

| QRS (QUERCUS) | 2025/Q3 | 42 | -17,65% | -6,67% |

| ASB (ASBIS) | 2025/Q3 | 42 | +10,53% | +7,69% |

| PGE | 2025/Q3 | 42 | -17,65% | -4,55% |

| PKN (PKNORLEN) | 2025/Q3 | 41 | +5,13% | 0,00% |

| DIA (DIAG) | 2025/Q3 | 41 | +5,13% | 0,00% |

| ABE (ABPL) | 2025/Q4 | 40 | 0,00% | 0,00% |

| 1AT (ATAL) | 2025/Q3 | 40 | +100,00% | +17,65% |

| WTN (WITTCHEN) | 2025/Q3 | 40 | -2,44% | -6,98% |

| ENT (ENTER) | 2025/Q3 | 37 | +12,12% | +5,71% |

| APR (AUTOPARTN) | 2025/Q3 | 36 | +5,88% | 0,00% |

| STX (STALEXP) | 2025/Q3 | 35 | +16,67% | -10,26% |

| VRC (VERCOM) | 2025/Q3 | 33 | -17,50% | -10,81% |

| ZAB (ZABKA) | 2025/Q3 | 33 | -8,33% | -2,94% |

| GPP (GRUPRACUJ) | 2025/Q3 | 32 | +3,23% | 0,00% |

| RBW (RAINBOW) | 2025/Q3 | 32 | -5,88% | -3,03% |

| CCC | 2025/Q3 | 32 | +68,42% | +18,52% |

| PEP | 2025/Q3 | 31 | -18,42% | -6,06% |

| MUR (MURAPOL) | 2025/Q3 | 31 | -24,39% | 0,00% |

| BFT (BENEFIT) | 2025/Q3 | 29 | +11,54% | 0,00% |

| ARL (ARLEN) | 2024/Q4 | 29 | +141,67% | |

| BMC (BUMECH) | 2025/Q3 | 28 | -31,71% | -17,65% |

| TAR (TARCZYNSKI) | 2025/Q3 | 27 | -10,00% | 0,00% |

| CBF (CYBERFLKS) | 2025/Q3 | 24 | -20,00% | -14,29% |

| MNC (MENNICA) | 2025/Q3 | 23 | +27,78% | 0,00% |

| ALE (ALLEGRO) | 2025/Q3 | 22 | -24,14% | -15,38% |

| SHO (SHOPER) | 2025/Q3 | 22 | +4,76% | -4,35% |

| DVL (DEVELIA) | 2025/Q3 | 22 | -43,59% | -21,43% |

| UNT (UNIMOT) | 2025/Q3 | 22 | -12,00% | 0,00% |

| KGH (KGHM) | 2025/Q3 | 18 | -14,29% | 0,00% |

| DOM (DOMDEV) | 2025/Q3 | 17 | -5,56% | -10,53% |

| EUR (EUROCASH) | 2025/Q3 | 16 | -5,88% | 0,00% |

| LPP | 2025/Q3 | 13 | -27,78% | -13,33% |

| DAD (DADELO) | 2025/Q3 | 11 | -42,11% | -26,67% |

| OPN (OPONEO.PL) | 2025/Q3 | 11 | 0,00% | 0,00% |

| KRU (KRUK) | 2025/Q3 | 10 | 0,00% | +11,11% |

| EAT (AMREST) | 2025/Q3 | 10 | -23,08% | 0,00% |

| VRG | 2025/Q3 | 6 | 0,00% | 0,00% |

| PCO (PEPCO) | 2025/Q4 | 5 | -16,67% | |

| DNP (DINOPL) | 2025/Q3 | 3 | -25,00% | 0,00% |

| XTB | 2025/Q3 | 1 | ||

| BCX (BIOCELTIX) | 2025/Q3 |

Wskaźniki prezentują jedynie użyteczne informacje dotyczące kondycji finansowej spółek i nie są rekomendacją w rozumieniu przepisów Rozporządzenia Ministra Finansów z dnia 19 października 2005 r. w sprawie informacji stanowiących rekomendacje dotyczące instrumentów finansowych lub ich emitentów (Dz. U. z 2005 r. Nr 206, poz. 1715).

Biznesradar bez reklam? Sprawdź BR Plus