Biznesradar bez reklam? Sprawdź BR Plus

Komponenty indeksu WIG140

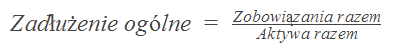

Wskaźniki zadłużenia: Zadłużenie ogólne

Zobacz opis wskaźnika

- Zadłużenie ogólne

Wskaźnik ogólnego zadłużenia (ang. debt ratio, DR) to wskaźnik finansowy stanowiący stosunek kapitałów obcych (zobowiązań) do aktywów.

Wskaźnik ogólnego zadłużenia jest najbardziej ogólnym obrazem struktury finansowania aktywów przedsiębiorstwa. Im większa jest wartość tego wskaźnika tym wyższe ryzyko ponosi kredytodawca. Stąd często przyjmuje się, że jego wartość powyżej 0,67 wskazuje na nadmierne ryzyko kredytowe. Niski poziom wskaźnika świadczy o samodzielności finansowej przedsiębiorstwa.

Przyjęty punkt odniesienia (norma) nie oznacza optymalnej struktury finansowania. Ta zależna jest m.in. od kosztu pozyskania kapitału, a także od generowanej stopy zwrotu (rentowności ekonomicznej, wskaźnika rentowności aktywów) przez przedsiębiorstwo.

źródło: Wikipedia, opr. wł.

źródło: Wikipedia, opr. wł.

| Profil | Raport | Zadłużenie ogólne | r/r | k/k |

|---|---|---|---|---|

| BMC (BUMECH) | 2025/Q3 | 1,83 | +357,27% | -5,67% |

| DAT (DATAWALK) | 2025/Q3 | 0,95 | +14,61% | -2,84% |

| PCO (PEPCO) | 2025/Q4 | 0,95 | +8,51% | |

| MIL (MILLENNIUM) | 2025/Q3 | 0,94 | -0,14% | -0,01% |

| ING (INGBSK) | 2025/Q4 | 0,92 | -1,05% | -0,86% |

| MBK (MBANK) | 2025/Q3 | 0,92 | -1,47% | -0,21% |

| EUR (EUROCASH) | 2025/Q3 | 0,91 | +0,18% | -0,33% |

| BOS | 2025/Q3 | 0,91 | +1,60% | +0,67% |

| BNP (BNPPPL) | 2025/Q4 | 0,90 | -0,61% | +0,12% |

| PKO (PKOBP) | 2025/Q3 | 0,90 | -0,11% | -0,52% |

| PEO (PEKAO) | 2025/Q4 | 0,90 | -0,54% | -0,24% |

| ZAB (ZABKA) | 2025/Q3 | 0,89 | -4,32% | -2,51% |

| SPL (SANPL) | 2025/Q3 | 0,89 | +0,59% | -0,65% |

| CLC (COLUMBUS) | 2025/Q3 | 0,88 | -19,24% | -1,11% |

| BHW (HANDLOWY) | 2025/Q3 | 0,88 | +2,02% | -0,89% |

| ALR (ALIOR) | 2025/Q3 | 0,88 | -0,71% | -1,01% |

| PZU | 2025/Q3 | 0,87 | -0,76% | -0,93% |

| BDX (BUDIMEX) | 2025/Q3 | 0,86 | +1,21% | -1,84% |

| UNI (UNIBEP) | 2025/Q3 | 0,84 | +1,42% | +0,67% |

| EAT (AMREST) | 2025/Q3 | 0,83 | +0,14% | -0,81% |

| ENT (ENTER) | 2025/Q3 | 0,82 | -2,76% | -2,58% |

| ATT (GRUPAAZOTY) | 2025/Q3 | 0,82 | +6,31% | -0,23% |

| OPN (OPONEO.PL) | 2025/Q3 | 0,80 | +10,26% | +7,13% |

| NEU (NEUCA) | 2025/Q3 | 0,80 | +5,79% | +3,22% |

| WLT (WIELTON) | 2025/Q3 | 0,80 | +9,91% | +1,83% |

| MLS (MLSYSTEM) | 2025/Q3 | 0,78 | +15,73% | +3,74% |

| XTB | 2025/Q3 | 0,78 | +14,14% | +2,98% |

| MDV (MODIVO) | 2025/Q3 | 0,78 | -8,58% | +0,22% |

| PXM (POLIMEXMS) | 2025/Q3 | 0,76 | -3,89% | -1,47% |

| ASB (ASBIS) | 2025/Q3 | 0,75 | +7,37% | +1,14% |

| MUR (MURAPOL) | 2025/Q3 | 0,74 | +0,53% | +0,11% |

| ECH (ECHO) | 2025/Q3 | 0,74 | +6,05% | -1,35% |

| LPP | 2025/Q3 | 0,74 | +4,02% | -1,34% |

| DIA (DIAG) | 2025/Q3 | 0,73 | -0,70% | -4,35% |

| WPL (WIRTUALNA) | 2025/Q3 | 0,73 | +31,55% | -7,13% |

| ERB (ERBUD) | 2025/Q3 | 0,73 | +9,19% | -0,22% |

| RVU (RYVU) | 2025/Q3 | 0,72 | +28,98% | +9,04% |

| UNT (UNIMOT) | 2025/Q3 | 0,72 | +3,77% | +2,58% |

| DOM (DOMDEV) | 2025/Q3 | 0,70 | -1,43% | -1,36% |

| 1AT (ATAL) | 2025/Q3 | 0,66 | +25,48% | -0,03% |

| ARH (ARCHICOM) | 2025/Q3 | 0,66 | +21,17% | +2,95% |

| PBX (PEKABEX) | 2025/Q3 | 0,65 | -4,42% | +2,38% |

| BFT (BENEFIT) | 2025/Q3 | 0,65 | -3,63% | -2,59% |

| DVL (DEVELIA) | 2025/Q3 | 0,65 | +0,70% | +5,22% |

| TAR (TARCZYNSKI) | 2025/Q3 | 0,65 | +3,28% | -1,69% |

| AGO (AGORA) | 2025/Q3 | 0,64 | -3,02% | -2,36% |

| ABE (ABPL) | 2025/Q4 | 0,64 | -0,47% | +10,06% |

| RBW (RAINBOW) | 2025/Q3 | 0,64 | -0,77% | -18,64% |

| MSZ (MOSTALZAB) | 2025/Q3 | 0,63 | +7,87% | +3,72% |

| KRU (KRUK) | 2025/Q3 | 0,60 | +0,86% | -1,45% |

| MBR (MOBRUK) | 2025/Q3 | 0,59 | +16,26% | +10,63% |

| PGE | 2025/Q3 | 0,59 | +13,57% | -3,95% |

| JSW | 2025/Q3 | 0,58 | +6,28% | +1,57% |

| MCR | 2025/Q2 | 0,58 | +23,92% | +7,38% |

| BRS (BORYSZEW) | 2025/Q3 | 0,58 | -1,37% | -2,92% |

| SNT (SYNEKTIK) | 2026/Q1 | 0,57 | +6,17% | +5,56% |

| COG (COGNOR) | 2025/Q3 | 0,57 | +4,32% | +0,79% |

| SVE (SNTVERSE) | 2025/Q3 | 0,57 | -6,08% | -7,42% |

| MRB (MIRBUD) | 2025/Q3 | 0,57 | +4,55% | +0,26% |

| DAD (DADELO) | 2025/Q3 | 0,57 | +47,47% | +2,51% |

| KTY (KETY) | 2025/Q3 | 0,57 | -1,24% | -7,14% |

| ELT (ELEKTROTI) | 2025/Q3 | 0,57 | -1,58% | +1,60% |

| TPE (TAURONPE) | 2025/Q3 | 0,56 | -8,92% | -2,23% |

| MLG (MLPGROUP) | 2025/Q3 | 0,56 | +5,56% | +0,36% |

| CRI (CREOTECH) | 2025/Q3 | 0,56 | +7,67% | +9,23% |

| OND (ONDE) | 2025/Q3 | 0,55 | +5,44% | -4,08% |

| CBF (CYBERFLKS) | 2025/Q3 | 0,55 | +19,93% | -13,81% |

| CAR (INTERCARS) | 2025/Q3 | 0,55 | +2,32% | +2,52% |

| GPP (GRUPRACUJ) | 2025/Q3 | 0,54 | -11,81% | -15,95% |

| CPS (CYFRPLSAT) | 2025/Q3 | 0,54 | -1,03% | +1,18% |

| TXT (TEXT) | 2025/Q2 | 0,54 | +16,89% | +54,80% |

| XTP (XTPL) | 2025/Q3 | 0,53 | +2,29% | +3,33% |

| SNK (SANOK) | 2025/Q3 | 0,52 | -1,04% | -5,75% |

| ENA (ENEA) | 2025/Q3 | 0,52 | +0,19% | +2,98% |

| ALL (AILLERON) | 2025/Q3 | 0,52 | -10,66% | -2,81% |

| TOR (TORPOL) | 2025/Q3 | 0,51 | -0,16% | +0,04% |

| QRS (QUERCUS) | 2025/Q3 | 0,51 | +12,30% | -10,25% |

| ACP (ASSECOPOL) | 2025/Q3 | 0,50 | -1,29% | -4,29% |

| ALE (ALLEGRO) | 2025/Q3 | 0,50 | +2,20% | +5,84% |

| OPL (ORANGEPL) | 2025/Q3 | 0,49 | +2,11% | -2,95% |

| PEP | 2025/Q3 | 0,49 | +35,45% | +0,97% |

| SLV (SELVITA) | 2025/Q3 | 0,48 | -4,40% | -1,55% |

| NWG (NEWAG) | 2025/Q3 | 0,48 | -7,90% | -8,71% |

| AMC (AMICA) | 2025/Q3 | 0,48 | -3,64% | -3,89% |

| ASE (ASSECOSEE) | 2025/Q3 | 0,47 | -14,83% | -16,83% |

| SEL (SELENAFM) | 2025/Q3 | 0,47 | -2,08% | -5,88% |

| ZEP (ZEPAK) | 2025/Q3 | 0,46 | +11,09% | -9,11% |

| FRO (FERRO) | 2025/Q3 | 0,46 | +5,27% | -0,39% |

| SKA (SNIEZKA) | 2025/Q3 | 0,46 | -14,34% | -12,55% |

| SHO (SHOPER) | 2025/Q3 | 0,46 | -20,22% | -17,20% |

| GEA (GRENEVIA) | 2025/Q3 | 0,45 | +12,12% | +3,29% |

| PKN (PKNORLEN) | 2025/Q4 | 0,44 | +2,73% | +2,32% |

| MNC (MENNICA) | 2025/Q3 | 0,43 | +20,38% | -11,09% |

| WTN (WITTCHEN) | 2025/Q3 | 0,43 | -14,69% | -11,29% |

| VOX (VOXEL) | 2025/Q3 | 0,42 | -4,38% | +0,91% |

| PCR (PCCROKITA) | 2025/Q3 | 0,42 | -9,93% | -9,50% |

| MAB (MABION) | 2025/Q3 | 0,42 | +50,13% | +13,44% |

| CIG (CIGAMES) | 2025/Q3 | 0,42 | +30,77% | +15,94% |

| KGH (KGHM) | 2025/Q3 | 0,41 | -4,65% | +0,66% |

| TEN (TSGAMES) | 2025/Q3 | 0,41 | -3,08% | -5,05% |

| AMB (AMBRA) | 2026/Q1 | 0,40 | -1,08% | +4,16% |

| VOT (VOTUM) | 2025/Q3 | 0,40 | -13,62% | -5,77% |

| CMP (COMP) | 2025/Q3 | 0,39 | -14,44% | -6,76% |

| KGN (KOGENERA) | 2025/Q3 | 0,39 | -9,89% | -4,69% |

| APT (APATOR) | 2025/Q3 | 0,39 | -3,00% | -2,09% |

| DNP (DINOPL) | 2025/Q3 | 0,39 | -8,07% | -5,38% |

| STX (STALEXP) | 2025/Q3 | 0,38 | -4,23% | -9,80% |

| BLO (BLOOBER) | 2025/Q3 | 0,38 | -1,09% | +2,68% |

| MDG (MEDICALG) | 2025/Q3 | 0,38 | +57,22% | +12,61% |

| APR (AUTOPARTN) | 2025/Q3 | 0,37 | -8,48% | +0,08% |

| VRG | 2025/Q3 | 0,37 | -4,02% | -2,16% |

| ATC (ARCTIC) | 2025/Q3 | 0,37 | +5,67% | -6,46% |

| FTE (FORTE) | 2025/Q2 | 0,33 | -14,86% | -6,48% |

| AST (ASTARTA) | 2025/Q3 | 0,33 | +17,10% | +8,36% |

| ACG (ACAUTOGAZ) | 2025/Q3 | 0,32 | +14,69% | +35,35% |

| VRC (VERCOM) | 2025/Q3 | 0,31 | -14,61% | -0,13% |

| DCR (DECORA) | 2025/Q3 | 0,31 | -1,05% | -5,57% |

| LWB (BOGDANKA) | 2025/Q3 | 0,28 | +5,82% | +6,74% |

| CTX (CAPTORTX) | 2025/Q3 | 0,25 | -30,48% | +35,80% |

| TOA (TOYA) | 2025/Q3 | 0,25 | -33,75% | -15,10% |

| SGN (SYGNITY) | 2025/Q3 | 0,24 | -10,29% | |

| ABS (ASSECOBS) | 2025/Q3 | 0,24 | -15,51% | -17,97% |

| VGO (VIGOPHOTN) | 2025/Q3 | 0,23 | -27,18% | +9,47% |

| BIO (BIOTON) | 2025/Q3 | 0,22 | -10,20% | -3,61% |

| LBW (LUBAWA) | 2025/Q3 | 0,22 | -12,59% | -2,35% |

| STP (STALPROD) | 2025/Q3 | 0,22 | -5,46% | -13,68% |

| GRX (GREENX) | 2024/Q4 | 0,22 | +81,34% | |

| ARL (ARLEN) | 2024/Q4 | 0,21 | -22,66% | |

| SCP (SCPFL) | 2025/Q3 | 0,19 | -20,69% | +11,16% |

| CLN (CLNPHARMA) | 2025/Q3 | 0,17 | +4,87% | -13,76% |

| GPW | 2025/Q3 | 0,17 | -9,36% | -36,40% |

| MCI | 2025/Q3 | 0,16 | +31,37% | -6,46% |

| WWL (WAWEL) | 2025/Q3 | 0,13 | -1,88% | -3,96% |

| MRC (MERCATOR) | 2025/Q3 | 0,11 | -11,21% | +2,81% |

| 11B (11BIT) | 2025/Q3 | 0,11 | -17,63% | +4,13% |

| PLW (PLAYWAY) | 2025/Q3 | 0,11 | -9,93% | -70,11% |

| HUG (HUUUGE) | 2025/Q3 | 0,10 | -37,73% | -7,74% |

| BCX (BIOCELTIX) | 2025/Q3 | 0,09 | +53,90% | -14,02% |

| CDR (CDPROJEKT) | 2025/Q3 | 0,07 | +7,46% | -27,27% |

| CRJ (CREEPYJAR) | 2025/Q3 | 0,04 | -15,61% | -1,96% |

Wskaźniki prezentują jedynie użyteczne informacje dotyczące kondycji finansowej spółek i nie są rekomendacją w rozumieniu przepisów Rozporządzenia Ministra Finansów z dnia 19 października 2005 r. w sprawie informacji stanowiących rekomendacje dotyczące instrumentów finansowych lub ich emitentów (Dz. U. z 2005 r. Nr 206, poz. 1715).

Biznesradar bez reklam? Sprawdź BR Plus