Biznesradar bez reklam? Sprawdź BR Plus

- Komponenty indeksu NCIndex •

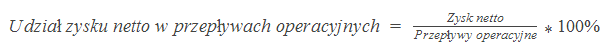

- Wskaźniki przepływów pienieżnych: Udział zysku netto w przepływach operacyjnych

Komponenty indeksu NCIndex Wskaźniki przepływów pienieżnych: Udział zysku netto w przepływach operacyjnych

Wskaźnik:

Zobacz opis wskaźnika

- Udział zysku netto w przepływach operacyjnych

Wskaźnik określa udział zysku w działalności operacyjnej przedsiębiorstwa.

W idealnych warunkach jego wartość powinna wynosić 100%, co w rzeczywistości praktycznie się nie zdarza. Im większa jego wartość tym lepiej, jednak gdy jego wartość przekrwacza 150% bądź jest ujemna nie powinniśmy go interpretować. Optymalna wartość wskaźnika mieści się w granicach 50 - 150%.

Biznesradar bez reklam? Sprawdź BR Plus

| Profil | Raport | Udział zysku netto w przepływach operacyjnych | ~ sektor | > ~sektor* | r/r | k/k | r/r > ~sektor** | k/k > ~sektor** |

|---|---|---|---|---|---|---|---|---|

| BTC (BTCSTUDIO) | 2023/Q4 | 36 100.00% | 47.65% | +36 052.35% | +30736.25% | +102685.96% | +30785.94% | +102666.30% |

| DUA (DUALITY) | 2023/Q4 | 329.85% | 47.65% | +282.20% | +275.07% | +4437.14% | +324.76% | +4417.48% |

| ECL (EASYCALL) | 2023/Q4 | 4 914.50% | 74.85% | +4 839.65% | +4832.26% | +4417.00% | +4781.17% | +4420.84% |

| TLG (TELGAM) | 2023/Q4 | 73.83% | 74.85% | -1.02% | +758.49% | +2761.63% | +707.40% | +2765.47% |

| OZE (OZECAPITAL) | 2023/Q4 | 103.97% | -1.28% | +105.25% | +101.91% | +2284.63% | +203.31% | +2390.80% |

| AUX (AUXILIA) | 2023/Q4 | 26.25% | 48.34% | -22.09% | +225.54% | +1934.88% | +230.62% | +1940.21% |

| SZR (SZAR) | 2023/Q4 | 2 755.93% | 74.63% | +2 681.30% | +44422.29% | +1677.70% | +43316.64% | +1263.19% |

| DDI (DDISTANCE) | 2023/Q4 | 921.95% | 47.65% | +874.30% | +6021.85% | +1339.87% | +6071.54% | +1320.21% |

| NGG (NGGAMES) | 2023/Q4 | 525.49% | 47.65% | +477.84% | +337.33% | +1182.00% | +387.02% | +1162.34% |

| JRC (JRCGROUP) | 2023/Q4 | 177.27% | 53.18% | +124.09% | +176.77% | +1131.90% | +189.89% | +1080.35% |

| CCS | 2023/Q4 | 373.82% | 74.63% | +299.19% | +139.99% | +866.18% | -965.66% | +451.67% |

| LMG (LMGAMES) | 2023/Q4 | 335.18% | 47.65% | +287.53% | -97.09% | +854.66% | -47.40% | +835.00% |

| TGS (TRUEGS) | 2023/Q4 | 40 755.56% | 47.65% | +40 707.91% | +1902.40% | +764.55% | +1952.09% | +744.89% |

| BEE (BEEIN) | 2023/Q4 | 33.01% | -1.28% | +34.29% | +142.37% | +731.17% | +243.77% | +837.34% |

| AQA (AQUAPOZ) | 2023/Q4 | 372.84% | 66.30% | +306.54% | +360.75% | +723.69% | +247.70% | +607.94% |

| P24 (PRESENT24) | 2023/Q4 | 1 101.96% | 59.74% | +1 042.22% | +477.38% | +602.92% | +306.42% | +664.81% |

| OPI (OPTIGIS) | 2023/Q4 | 230.93% | 74.63% | +156.30% | +356.22% | +580.01% | -749.43% | +165.50% |

| EMP (EMPLOCITY) | 2023/Q4 | 102.48% | 47.65% | +54.83% | +121.25% | +491.15% | +170.94% | +471.49% |

| MDA (MEDAPP) | 2023/Q4 | 140.27% | 136.09% | +4.18% | +1218.33% | +473.75% | +1118.76% | +382.85% |

| MNS (MENNICASK) | 2023/Q4 | 212.27% | 59.74% | +152.53% | +141.81% | +432.14% | -29.15% | +494.03% |

| IFA (INFRA) | 2023/Q4 | 187.50% | 47.65% | +139.85% | +587.57% | +410.48% | +637.26% | +390.82% |

| SNG (SYNERGA) | 2023/Q4 | 506.67% | 85.76% | +420.91% | +6.98% | +392.32% | -40.15% | +161.93% |

| EBX (EKOBOX) | 2023/Q4 | 184.16% | 66.30% | +117.86% | +2.24% | +368.84% | -110.81% | +253.09% |

| GDC (GAMEDUST) | 2023/Q4 | 1 788.28% | 136.09% | +1 652.19% | +132.90% | +356.64% | +33.33% | +265.74% |

| SBE (SOFTBLUE) | 2023/Q4 | 71.02% | 53.18% | +17.84% | +359.68% | +343.60% | +372.80% | +292.05% |

| YOS (YOSHI) | 2023/Q4 | 2 012.24% | 47.65% | +1 964.59% | +147.36% | +317.86% | +197.05% | +298.20% |

| AIT (AITON) | 2023/Q4 | 1 733.33% | 74.85% | +1 658.48% | +956.33% | +301.24% | +905.24% | +305.08% |

| UFG (UFGAMES) | 2023/Q4 | 89.22% | 47.65% | +41.57% | +0.70% | +299.73% | +50.39% | +280.07% |

| COS (COSMA) | 2023/Q4 | 277.96% | 25.84% | +252.12% | +75.80% | +285.84% | +136.92% | +350.91% |

| MVR (MOVGAMVR) | 2023/Q4 | 500.00% | 47.65% | +452.35% | +265.71% | +255.27% | +315.40% | +235.61% |

Biznesradar bez reklam? Sprawdź BR Plus |

||||||||

| Profil | Raport | Udział zysku netto w przepływach operacyjnych | ~ sektor | > ~sektor* | r/r | k/k | r/r > ~sektor** | k/k > ~sektor** |

| ONE (1SOLUTION) | 2023/Q4 | 42.21% | 48.34% | -6.13% | +6935.00% | +242.06% | +6940.08% | +247.39% |

| PTN (POLTRONIC) | 2023/Q4 | 39.41% | 74.63% | -35.22% | -48.58% | +212.53% | -1154.23% | -201.98% |

| NWA (NWAI) | 2023/Q4 | 85.76% | 85.76% | 0.00% | +405.09% | +207.58% | +357.96% | -22.81% |

| ATA (ATCCARGO) | 2023/Q4 | 497.69% | 25.84% | +471.85% | +387.17% | +207.46% | +448.29% | +272.53% |

| PLI (PLATIGE) | 2023/Q4 | 208.64% | 136.09% | +72.55% | +205.97% | +192.66% | +106.40% | +101.76% |

| EXC (EXCELLENC) | 2023/Q4 | 53.11% | 74.63% | -21.52% | +275.07% | +175.61% | -830.58% | -238.90% |

| EPR (EKOPARK) | 2023/Q4 | 33.62% | 66.30% | -32.68% | +126.20% | +172.74% | +13.15% | +56.99% |

| KLN (KLON) | 2023/Q4 | 0.54% | 66.30% | -65.76% | -97.04% | +164.29% | -210.09% | +48.54% |

| IPW (IMAGEPWR) | 2023/Q4 | 130.16% | 47.65% | +82.51% | +1543.43% | +163.56% | +1593.12% | +143.90% |

| DGS (DEMGAMES) | 2023/Q4 | 38.12% | 47.65% | -9.53% | +199.45% | +153.46% | +249.14% | +133.80% |

| NOB (NOOBZ) | 2023/Q4 | 81.27% | 47.65% | +33.62% | +340.02% | +146.87% | +389.71% | +127.21% |

| QUB (QUBICGMS) | 2023/Q4 | 20.18% | 47.65% | -27.47% | -98.68% | +138.53% | -48.99% | +118.87% |

| MMS (MADMIND) | 2023/Q3 | 25.41% | 39.82% | -14.41% | -55.81% | +137.81% | -31.18% | +161.86% |

| MTN (MILTON) | 2023/Q4 | 21.12% | 53.18% | -32.06% | -96.99% | +136.61% | -83.87% | +85.06% |

| OLY (OLYMP) | 2023/Q4 | 83.20% | +1022.39% | +133.64% | ||||

| OUT (OUTDOORZY) | 2023/Q4 | 110.92% | 74.63% | +36.29% | +235.72% | +133.53% | -869.93% | -280.98% |

| BRP (BLACKROSE) | 2023/Q4 | 106.15% | 47.65% | +58.50% | +1925.76% | +131.21% | +1975.45% | +111.55% |

| SEV (SEVENET) | 2023/Q2 | 24.16% | 52.43% | -28.27% | +212.22% | +127.50% | +191.15% | +144.55% |

| AQT (AQUATECH) | 2023/Q3 | 84.22% | 36.82% | +47.40% | +172.69% | +125.34% | +171.73% | +105.60% |

| PIT (POLARISIT) | 2023/Q4 | 7.32% | 25.84% | -18.52% | -76.81% | +113.21% | -15.69% | +178.28% |

| SNN (SUNNET) | 2023/Q4 | 188.07% | 47.65% | +140.42% | +38.33% | +111.03% | +88.02% | +91.37% |

| HUB (HUBTECH) | 2023/Q4 | 73.64% | 53.18% | +20.46% | +47.37% | +109.86% | +60.49% | +58.31% |

| APS | 2023/Q4 | 145.21% | 53.18% | +92.03% | +116.25% | +108.86% | +129.37% | +57.31% |

| LXB (LEXBONO) | 2023/Q4 | 125.29% | 48.34% | +76.95% | +258.05% | +107.86% | +263.13% | +113.19% |

| ARG (ARTGAMES) | 2023/Q4 | 133.14% | 47.65% | +85.49% | +144.61% | +105.39% | +194.30% | +85.73% |

| MBF (MBFGROUP) | 2023/Q4 | 41.89% | 47.65% | -5.76% | -74.36% | +104.77% | -24.67% | +85.11% |

| S4E | 2023/Q4 | 26.36% | 53.18% | -26.82% | +123.10% | +103.43% | +136.22% | +51.88% |

| PTW (PTWP) | 2023/Q4 | 155.69% | 136.09% | +19.60% | +27.89% | +102.56% | -71.68% | +11.66% |

| EGH (EKOPOL) | 2023/Q4 | 28.36% | 53.18% | -24.82% | +100.05% | +100.70% | +113.17% | +49.15% |

| CAI (CARLSON) | 2023/Q4 | 106.36% | 85.76% | +20.60% | +109.26% | +100.41% | +62.13% | -129.98% |

| Profil | Raport | Udział zysku netto w przepływach operacyjnych | ~ sektor | > ~sektor* | r/r | k/k | r/r > ~sektor** | k/k > ~sektor** |

| DRF (DRFINANCE) | 2023/Q4 | 4.28% | 48.34% | -44.06% | -96.40% | +100.10% | -91.32% | +105.43% |

| VFA (VRFABRIC) | 2023/Q4 | -96.71% | 47.65% | -144.36% | -269.93% | +99.03% | -220.24% | +79.37% |

| AGL (AGROLIGA) | 2023/Q4 | -0.16% | 25.84% | -26.00% | +99.46% | +98.91% | +160.58% | +163.98% |

| TNT (TNTPROENR) | 2023/Q4 | -25.82% | -1.28% | -24.54% | -102.45% | +98.18% | -1.05% | +204.35% |

| SDG (SUNDRAGON) | 2023/Q4 | -137.41% | 53.18% | -190.59% | +82.49% | +97.68% | +95.61% | +46.13% |

| OVI (OVIDWORKS) | 2023/Q4 | -169.81% | 47.65% | -217.46% | -462.84% | +97.34% | -413.15% | +77.68% |

| ERA (ERATONRG) | 2023/Q4 | -10.07% | -1.28% | -8.79% | -111.47% | +96.83% | -10.07% | +203.00% |

| RBS (ROBINSON) | 2024/Q1 | -79.22% | -79.22% | 0.00% | -166.02% | +95.55% | +51.13% | +301.70% |

| THD (THEDUST) | 2023/Q4 | 216.14% | 47.65% | +168.49% | +63.42% | +91.21% | +113.11% | +71.55% |

| SED (SEDIVIO) | 2023/Q4 | -358.37% | 47.65% | -406.02% | +3.80% | +88.88% | +53.49% | +69.22% |

| K2P (KOOL2PLAY) | 2023/Q4 | 388.62% | 47.65% | +340.97% | +314.93% | +87.22% | +364.62% | +67.56% |

| APA (APANET) | 2023/Q4 | -188.76% | 53.18% | -241.94% | -112.94% | +84.79% | -99.82% | +33.24% |

| MAD (MADKOM) | 2023/Q4 | 32.00% | 47.65% | -15.65% | +31.58% | +82.86% | +81.27% | +63.20% |

| FVE (FOTOVOLT) | 2023/Q4 | 17.26% | -1.28% | +18.54% | -83.01% | +77.57% | +18.39% | +183.74% |

| BPC | 2023/Q4 | -1 253.79% | 85.76% | -1 339.55% | +34.13% | +76.40% | -13.00% | -153.99% |

| KOR (KORBANK) | 2023/Q4 | 137.04% | 74.85% | +62.19% | +28.97% | +68.52% | -22.12% | +72.36% |

| MXP (MAXIPIZZA) | 2023/Q4 | 35.67% | 51.75% | -16.08% | -95.08% | +62.14% | -25.41% | +11.44% |

| MLM (MILISYS) | 2023/Q4 | 55.01% | 47.65% | +7.36% | +375.04% | +59.13% | +424.73% | +39.47% |

| BTK (BIZTECH) | 2023/Q4 | -31.55% | 47.65% | -79.20% | -236.70% | +55.99% | -187.01% | +36.33% |

| VRF (VRFACTORY) | 2023/Q4 | -74.24% | 47.65% | -121.89% | -103.97% | +53.81% | -54.28% | +34.15% |

| CFS (CFSA) | 2023/Q4 | 99.57% | 48.34% | +51.23% | +90.02% | +53.75% | +95.10% | +59.08% |

| AZC (AZTEC) | 2023/Q4 | -47.69% | 66.30% | -113.99% | -150.21% | +53.51% | -263.26% | -62.24% |

| O2T (ONE2TRIBE) | 2023/Q4 | -88.56% | 47.65% | -136.21% | +93.76% | +51.99% | +143.45% | +32.33% |

| F51 (FARM51) | 2023/Q4 | -30.93% | 47.65% | -78.58% | -103.35% | +50.42% | -53.66% | +30.76% |

| GOV (GOVENA) | 2023/Q4 | -7.13% | 53.18% | -60.31% | +85.00% | +49.72% | +98.12% | -1.83% |

| TRX (TREX) | 2023/Q4 | 87.31% | 48.34% | +38.97% | +76.60% | +45.23% | +81.68% | +50.56% |

| AVE (ADVERTIGO) | 2023/Q4 | 40.00% | 136.09% | -96.09% | +1020.45% | +44.88% | +920.88% | -46.02% |

| DNS (DANKS) | 2023/Q4 | -37.21% | 48.34% | -85.55% | -103.35% | +43.65% | -98.27% | +48.98% |

| ASR (ASTRO) | 2023/Q4 | 375.72% | 136.09% | +239.63% | +139.28% | +37.38% | +39.71% | -53.52% |

| SMT (SIMTERACT) | 2023/Q4 | -20.45% | 47.65% | -68.10% | -553.35% | +36.31% | -503.66% | +16.65% |

| Profil | Raport | Udział zysku netto w przepływach operacyjnych | ~ sektor | > ~sektor* | r/r | k/k | r/r > ~sektor** | k/k > ~sektor** |

| DEG (DETGAMES) | 2023/Q4 | 1 146.34% | 47.65% | +1 098.69% | +276.95% | +36.08% | +326.64% | +16.42% |

| RDG (READGENE) | 2023/Q4 | 174.81% | 53.18% | +121.63% | +185.59% | +32.78% | +198.71% | -18.77% |

| NOV (NOVINA) | 2023/Q4 | 104.43% | 85.76% | +18.67% | +18.19% | +29.81% | -28.94% | -200.58% |

| INT (INTERNITY) | 2023/Q4 | 51.56% | 66.30% | -14.74% | -20.24% | +25.18% | -133.29% | -90.57% |

| EKS (EKIOSK) | 2023/Q4 | 37.84% | 59.74% | -21.90% | -62.25% | +23.46% | -233.21% | +85.35% |

| TMP (TELEMEDPL) | 2023/Q4 | 129.34% | 50.69% | +78.65% | -1.49% | +21.49% | +51.79% | +73.88% |

| HPM (HIPROMINE) | 2023/Q4 | 61.92% | 25.84% | +36.08% | -16.21% | +19.05% | +44.91% | +84.12% |

| HOR (HORTICO) | 2023/Q4 | 109.37% | 74.63% | +34.74% | -90.88% | +17.86% | -1196.53% | -396.65% |

| WOD (WODKAN) | 2023/Q4 | -14.02% | 25.84% | -39.86% | -487.29% | +16.80% | -426.17% | +81.87% |

| BPN (BLACKPOIN) | 2023/Q4 | 21.91% | -7.84% | +29.75% | -66.69% | +14.23% | +43.71% | +135.52% |

| MPY (MPAY) | 2023/Q4 | -7.95% | 48.34% | -56.29% | +67.31% | +13.87% | +72.39% | +19.20% |

| IMR (INTM) | 2023/Q4 | 200.23% | 47.65% | +152.58% | -60.90% | +13.14% | -11.21% | -6.52% |

| ORL (ORZLOPONY) | 2023/Q4 | 61.60% | -7.84% | +69.44% | -27.54% | +10.49% | +82.86% | +131.78% |

| LUG | 2023/Q4 | 95.30% | 66.30% | +29.00% | +453.11% | +8.85% | +340.06% | -106.90% |

| STA (STARWARD) | 2023/Q4 | 39.03% | 47.65% | -8.62% | -52.71% | +7.11% | -3.02% | -12.55% |

| VER (MPLVERBUM) | 2023/Q3 | 26.26% | 73.97% | -47.71% | -30.91% | +4.08% | -337.56% | -49.00% |

| 7FT (7FIT) | 2023/Q4 | 170.81% | 74.63% | +96.18% | -80.30% | +0.40% | -1185.95% | -414.11% |

| EXA (EXAMOBILE) | 2023/Q4 | 95.78% | 47.65% | +48.13% | +1.13% | -2.16% | +50.82% | -21.82% |

| RSP (REMORSOL) | 2023/Q4 | 117.34% | -1.28% | +118.62% | -45.02% | -3.00% | +56.38% | +103.17% |

| FOR (FOREVEREN) | 2023/Q4 | 181.68% | 47.65% | +134.03% | -87.24% | -3.24% | -37.55% | -22.90% |

| TLS (TELESTR) | 2023/Q4 | 74.85% | 74.85% | 0.00% | +53.89% | -3.84% | +2.80% | 0.00% |

| GX1 (GENXONE) | 2023/Q4 | 80.55% | 53.18% | +27.37% | -43.78% | -4.02% | -30.66% | -55.57% |

| GMB (GAMESBOX) | 2023/Q4 | 28.28% | 47.65% | -19.37% | -39.84% | -4.10% | +9.85% | -23.76% |

| MO2 (MOLIERA2) | 2023/Q4 | -464.10% | 25.84% | -489.94% | -344.25% | -4.24% | -283.13% | +60.83% |

| AOL (ANALIZY) | 2023/Q4 | 52.37% | 25.84% | +26.53% | -28.90% | -4.64% | +32.22% | +60.43% |

| TME (TERMOEXP) | 2023/Q4 | 113.58% | 66.30% | +47.28% | -82.17% | -5.48% | -195.22% | -121.23% |

| SYG (SYGNIS) | 2023/Q4 | 1 402.39% | 53.18% | +1 349.21% | +3674.94% | -5.90% | +3688.06% | -57.45% |

| CHP (CHERRY) | 2023/Q4 | 78.09% | 47.65% | +30.44% | -36.78% | -6.11% | +12.91% | -25.77% |

| GRC (GRUPAREC) | 2023/Q4 | 37.39% | -7.84% | +45.23% | +0.32% | -6.22% | +110.72% | +115.07% |

| NST (NESTMEDIC) | 2023/Q4 | 97.12% | 50.69% | +46.43% | +61.06% | -6.25% | +114.34% | +46.14% |

| Profil | Raport | Udział zysku netto w przepływach operacyjnych | ~ sektor | > ~sektor* | r/r | k/k | r/r > ~sektor** | k/k > ~sektor** |

| SDS (SDSOPTIC) | 2023/Q4 | 70.68% | 53.18% | +17.50% | +26.21% | -6.40% | +39.33% | -57.95% |

| NCL (NOCTILUCA) | 2023/Q4 | 103.65% | 53.18% | +50.47% | +11.16% | -6.85% | +24.28% | -58.40% |

| AQU (AQUABB) | 2023/Q4 | 25.82% | 25.84% | -0.02% | +9.08% | -8.76% | +70.20% | +56.31% |

| FRW (FROZENWAY) | 2023/Q4 | 131.86% | -35.30% | -8.84% | ||||

| KBT (KLABATER) | 2023/Q4 | 140.85% | 47.65% | +93.20% | +28.77% | -12.63% | +78.46% | -32.29% |

| ETX (EUROTAX) | 2023/Q4 | 48.78% | 48.34% | +0.44% | -31.66% | -13.28% | -26.58% | -7.95% |

| LGT (LGTRADE) | 2023/Q4 | 75.10% | 47.65% | +27.45% | -35.67% | -15.35% | +14.02% | -35.01% |

| ESG (ESHOPPING) | 2023/Q4 | 114.27% | 25.84% | +88.43% | +44.70% | -17.01% | +105.82% | +48.06% |

| ECC (ECCGAMES) | 2023/Q4 | 245.43% | 47.65% | +197.78% | -31.38% | -18.43% | +18.31% | -38.09% |

| RST (ROAD) | 2023/Q4 | -11.24% | 47.65% | -58.89% | -106.70% | -18.44% | -57.01% | -38.10% |

| 4MS (4MASS) | 2023/Q4 | 135.70% | 74.63% | +61.07% | +100.70% | -18.80% | -1004.95% | -433.31% |

| HMP (HEMP) | 2023/Q4 | 149.42% | 74.63% | +74.79% | +101.95% | -19.00% | -1003.70% | -433.51% |

| MLB (MAKOLAB) | 2023/Q4 | 68.39% | 47.65% | +20.74% | -56.68% | -20.87% | -6.99% | -40.53% |

| GMV (GAMIVO) | 2023/Q4 | 66.52% | 47.65% | +18.87% | -30.73% | -23.02% | +18.96% | -42.68% |

| PRN (PARTNER) | 2023/Q4 | 91.67% | 25.20% | +66.47% | -97.38% | -23.98% | -328.49% | +62.96% |

| KLE (KLEPSYDRA) | 2023/Q4 | 261.44% | 25.84% | +235.60% | +51.95% | -26.60% | +113.07% | +38.47% |

| DKR (DEKTRA) | 2023/Q4 | 12.67% | 74.63% | -61.96% | -95.12% | -27.14% | -1200.77% | -441.65% |

| EEE (EKIPA) | 2023/Q4 | 144.04% | 25.84% | +118.20% | -16.61% | -30.92% | +44.51% | +34.15% |

| GNG (GENRG) | 2023/Q1 | 10.77% | 15.79% | -5.02% | -38.70% | -34.21% | +0.25% | +48.57% |

| BKD (BKDGAMES) | 2023/Q4 | 121.34% | 47.65% | +73.69% | -18.75% | -34.86% | +30.94% | -54.52% |

| T2P (TERMO2PWR) | 2023/Q4 | 19.75% | -1.28% | +21.03% | -79.33% | -34.97% | +22.07% | +71.20% |

| GME (GRMEDIA) | 2023/Q4 | 41.94% | 136.09% | -94.15% | -1.89% | -35.25% | -101.46% | -126.15% |

| ZRX (ZORTRAX) | 2023/Q4 | 279.03% | 53.18% | +225.85% | +104.24% | -35.89% | +117.36% | -87.44% |

| GPH (GRAPHENE) | 2023/Q4 | 118.24% | 53.18% | +65.06% | +10.14% | -38.13% | +23.26% | -89.68% |

| UNV (UNIVERSE) | 2023/Q4 | -29.17% | 53.18% | -82.35% | -1168.50% | -38.57% | -1155.38% | -90.12% |

| MER (MERA) | 2023/Q4 | 4.14% | 66.30% | -62.16% | -83.27% | -39.12% | -196.32% | -154.87% |

| PRS (PRYMUS) | 2023/Q4 | 121.86% | 74.63% | +47.23% | -4.47% | -42.61% | -1110.12% | -457.12% |

| DRG (DRAGEUS) | 2023/Q4 | 30.11% | 47.65% | -17.54% | -48.38% | -42.91% | +1.31% | -62.57% |

| WRL (WIERZYCL) | 2023/Q4 | 128.31% | 48.34% | +79.97% | -77.05% | -43.70% | -71.97% | -38.37% |

| SCS (STEMCELLS) | 2023/Q4 | -45.16% | 50.69% | -95.85% | -899.12% | -44.05% | -845.84% | +8.34% |

| Profil | Raport | Udział zysku netto w przepływach operacyjnych | ~ sektor | > ~sektor* | r/r | k/k | r/r > ~sektor** | k/k > ~sektor** |

| SLT (SAULETECH) | 2023/Q4 | 203.28% | 53.18% | +150.10% | -47.15% | -44.72% | -34.03% | -96.27% |

| IVO (INCUVO) | 2023/Q4 | 46.61% | 47.65% | -1.04% | -64.05% | -45.69% | -14.36% | -65.35% |

| GAL (GALVO) | 2023/Q4 | 41.46% | 53.18% | -11.72% | -56.12% | -46.43% | -43.00% | -97.98% |

| RGL (ROBSGROUP) | 2023/Q4 | 12.04% | 25.84% | -13.80% | +108.77% | -46.54% | +169.89% | +18.53% |

| IWS (IRONWOLF) | 2023/Q4 | 27.25% | 47.65% | -20.40% | +137.64% | -47.42% | +187.33% | -67.08% |

| CBD (CANNABIS) | 2023/Q4 | 96.00% | 25.84% | +70.16% | -49.30% | -47.91% | +11.82% | +17.16% |

| LTM (LTGAMES) | 2023/Q4 | 181.59% | 47.65% | +133.94% | +22.33% | -50.00% | +72.02% | -69.66% |

| KPI (KANCELWEC) | 2023/Q4 | 96.95% | 48.34% | +48.61% | +318.95% | -50.20% | +324.03% | -44.87% |

| SOK (SONKA) | 2023/Q4 | -260.37% | 47.65% | -308.02% | -72425.00% | -50.27% | -72375.31% | -69.93% |

| LCN (LABOCANNA) | 2023/Q4 | 55.36% | 25.84% | +29.52% | -86.65% | -51.26% | -25.53% | +13.81% |

| PMG (PGMSA) | 2023/Q4 | 39.72% | 25.84% | +13.88% | -56.34% | -51.98% | +4.78% | +13.09% |

| CLA (CONSOLE) | 2023/Q4 | 28.10% | 47.65% | -19.55% | -84.45% | -58.20% | -34.76% | -77.86% |

| NTS (NOTORIA) | 2023/Q4 | 31.58% | 25.84% | +5.74% | -45.80% | -58.39% | +15.32% | +6.68% |

| DEV (DEVORAN) | 2023/Q4 | 37.34% | -1.28% | +38.62% | -91.27% | -59.86% | +10.13% | +46.31% |

| RRH (ROOFRENOV) | 2023/Q4 | 25.85% | 25.84% | +0.01% | -51.09% | -61.06% | +10.03% | +4.01% |

| ATJ (ATOMJELLY) | 2023/Q4 | 76.30% | 47.65% | +28.65% | -42.18% | -63.16% | +7.51% | -82.82% |

| MDP (MEDCAMP) | 2023/Q4 | 99.90% | 50.69% | +49.21% | -87.69% | -64.35% | -34.41% | -11.96% |

| IVE (INVESTEKO) | 2023/Q4 | 7.29% | -1.28% | +8.57% | +369.00% | -64.85% | +470.40% | +41.32% |

| YAN (NEPTIS) | 2023/Q4 | 48.69% | 47.65% | +1.04% | -88.94% | -68.81% | -39.25% | -88.47% |

| GMZ (GRUPAMZ) | 2023/Q4 | 200.82% | 25.84% | +174.98% | +38.49% | -72.18% | +99.61% | -7.11% |

| GRM (GREMPCO) | 2023/Q4 | -195.70% | 85.76% | -281.46% | -71.77% | -76.01% | -118.90% | -306.40% |

| KUB (KUBOTA) | 2023/Q4 | 81.64% | 59.74% | +21.90% | +196.97% | -77.24% | +26.01% | -15.35% |

| CRB (CARBONSTU) | 2023/Q4 | 8.71% | 47.65% | -38.94% | +116.77% | -78.13% | +166.46% | -97.79% |

| FHD (FHDOM) | 2023/Q4 | 47.89% | 48.34% | -0.45% | -79.67% | -81.43% | -74.59% | -76.10% |

| KBJ | 2023/Q4 | 72.30% | 47.65% | +24.65% | +373.76% | -82.59% | +423.45% | -102.25% |

| KPC (KUPIEC) | 2023/Q4 | 12.56% | 25.84% | -13.28% | +66.80% | -85.00% | +127.92% | -19.93% |

| AMV (ASMODEV) | 2023/Q4 | 176.47% | 47.65% | +128.82% | -69.07% | -87.72% | -19.38% | -107.38% |

| END (ENEIDA) | 2023/Q4 | 12.57% | 47.65% | -35.08% | -94.50% | -89.62% | -44.81% | -109.28% |

| TOS (TAMEX) | 2023/Q4 | 1.88% | 66.30% | -64.42% | -93.96% | -93.88% | -207.01% | -209.63% |

| LUO (LUON) | 2023/Q4 | 3.62% | 66.30% | -62.68% | -92.79% | -94.53% | -205.84% | -210.28% |

| Profil | Raport | Udział zysku netto w przepływach operacyjnych | ~ sektor | > ~sektor* | r/r | k/k | r/r > ~sektor** | k/k > ~sektor** |

| PNT (POINTPACK) | 2023/Q4 | 0.77% | 25.84% | -25.07% | +103.24% | -94.64% | +164.36% | -29.57% |

| INM (INVENTION) | 2023/Q4 | -584.09% | 53.18% | -637.27% | +53.65% | -95.30% | +66.77% | -146.85% |

| EKE (EKOOZE) | 2023/Q4 | 9 625.00% | 50.69% | +9 574.31% | +387.99% | -96.96% | +441.27% | -44.57% |

| ECT (ECO5TECH) | 2023/Q4 | 86.07% | 53.18% | +32.89% | +945.48% | -98.20% | +958.60% | -149.75% |

| SFD | 2023/Q4 | 7.03% | 59.74% | -52.71% | +104.41% | -98.21% | -66.55% | -36.32% |

| EFE (EFENERGII) | 2023/Q4 | 37.29% | 47.65% | -10.36% | -99.55% | -99.64% | -49.86% | -119.30% |

| ADX (ADATEX) | 2023/Q4 | 3.65% | 25.20% | -21.55% | +117.13% | -99.93% | -113.98% | -12.99% |

| LEG (LEGIMI) | 2023/Q4 | -10.00% | 47.65% | -57.65% | -199.01% | -104.01% | -149.32% | -123.67% |

| 4MB (4MOBILITY) | 2023/Q4 | -80.30% | 25.84% | -106.14% | -173.23% | -104.46% | -112.11% | -39.39% |

| VLT (VOOLT) | 2023/Q4 | -169.38% | -1.28% | -168.10% | -161.67% | -105.14% | -60.27% | +1.03% |

| ICG (ICECODE) | 2023/Q4 | -50.53% | 47.65% | -98.18% | -112.48% | -105.58% | -62.79% | -125.24% |

| LPS (LAURENPES) | 2023/Q4 | -453.47% | 25.84% | -479.31% | -678.62% | -112.18% | -617.50% | -47.11% |

| SUN (SUNTECH) | 2023/Q4 | -145.90% | 47.65% | -193.55% | -147.27% | -115.24% | -97.58% | -134.90% |

| VEE | 2023/Q4 | -125.77% | 47.65% | -173.42% | -188.34% | -115.80% | -138.65% | -135.46% |

| EON (EONET) | 2023/Q4 | -40.31% | 47.65% | -87.96% | -112.90% | -118.48% | -63.21% | -138.14% |

| BEP (BIOMASS) | 2023/Q4 | -9.85% | -1.28% | -8.57% | -110.05% | -126.62% | -8.65% | -20.45% |

| LUK (LUKARDI) | 2023/Q4 | -5.13% | 47.65% | -52.78% | -184.24% | -126.79% | -134.55% | -146.45% |

| DTX (DITIX) | 2023/Q4 | -1 000.00% | 48.34% | -1 048.34% | -1042.42% | -133.06% | -1037.34% | -127.73% |

| VAR (VARSAV) | 2023/Q4 | -5.86% | 47.65% | -53.51% | -105.55% | -147.45% | -55.86% | -167.11% |

| MSM | 2023/Q4 | -56.04% | 50.69% | -106.73% | -126.24% | -149.20% | -72.96% | -96.81% |

| ZEN (ZENERIS) | 2023/Q4 | -30.74% | -1.28% | -29.46% | -220.03% | -176.98% | -118.63% | -70.81% |

| RCM (REDCARPET) | 2023/Q4 | -431.85% | -155.71% | -190.63% | ||||

| PLM (POLMAN) | 2023/Q4 | -37.59% | -7.84% | -29.75% | -329.35% | -202.09% | -218.95% | -80.80% |

| YTF (YETIFORCE) | 2023/Q4 | -101.59% | -736.93% | -218.36% | ||||

| PDG (PYRAMID) | 2023/Q4 | -344.44% | 47.65% | -392.09% | -67.48% | -219.37% | -17.79% | -239.03% |

| PAC (PROACTA) | 2023/Q4 | -333.58% | 47.65% | -381.23% | -231.19% | -219.77% | -181.50% | -239.43% |

| GTS (GEOTRANS) | 2023/Q4 | -540.19% | -7.84% | -532.35% | -590.55% | -220.42% | -480.15% | -99.13% |

| BHX (BINARY) | 2023/Q4 | -118.00% | 53.18% | -171.18% | -101.88% | -232.01% | -88.76% | -283.56% |

| BSH | 2023/Q4 | -89.78% | -164.76% | -237.27% | ||||

| CMI | 2023/Q4 | -84.05% | 53.18% | -137.23% | -227.27% | -255.68% | -214.15% | -307.23% |

| ECN (ECNOLOGY) | 2023/Q4 | -141.41% | 48.34% | -189.75% | -305.69% | -264.87% | -300.61% | -259.54% |

| MFD (MFOOD) | 2023/Q4 | -120.91% | 74.63% | -195.54% | -253.23% | -364.75% | -1358.88% | -779.26% |

| IGT (IGORIA) | 2023/Q4 | -19.39% | 48.34% | -67.73% | +11.38% | -389.84% | +16.46% | -384.51% |

| JJB (JUJUBEE) | 2023/Q4 | -81.40% | 47.65% | -129.05% | -179.87% | -414.77% | -130.18% | -434.43% |

| FIG (FIGENE) | 2023/Q4 | -896.70% | -1.28% | -895.42% | -29990.60% | -1075.85% | -29889.20% | -969.68% |

| P2C (P2CHILL) | 2023/Q4 | -103.26% | 47.65% | -150.91% | -355.40% | -1223.85% | -305.71% | -1243.51% |

| OML (ONEMORE) | 2023/Q4 | -11 738.32% | 47.65% | -11 785.97% | -32975.01% | -4115.74% | -32925.32% | -4135.40% |

| MDB (MEDICOBIO) | 2023/Q4 | -53 440.00% | 50.69% | -53 490.69% | -32388.30% | -5562.03% | -32335.02% | -5509.64% |

| VRB (VERBICOM) | 2023/Q4 | -23.69% | 53.18% | -76.87% | -177.93% | -15693.33% | -164.81% | -15744.88% |

| IMG (IMMGAMES) | 2023/Q4 | -813.89% | 47.65% | -861.54% | -551.48% | -42936.32% | -501.79% | -42955.98% |

| QNA (QNATECHNO) | 2023/Q4 | 64.90% | 53.18% | +11.72% | -43.54% | -30.42% | ||

| FRM (FREEMIND) | 2023/Q4 | 117.39% | 47.65% | +69.74% | -31.25% | +18.44% | ||

| CWA (CONSOLEW) | 2023/Q4 | 69.41% | 47.65% | +21.76% | +24.93% | +74.62% | ||

| PLT (PLOTTWIST) | 2023/Q4 | 35.94% | 47.65% | -11.71% | +32.91% | +82.60% | ||

| FOX (SPACEFOX) | 2023/Q4 | 65.01% | 47.65% | +17.36% | +9660.29% | +9709.98% | ||

| RSG (RSGAMES) | 2023/Q4 | -346.41% | 47.65% | -394.06% | -7581.86% | -7532.17% | ||

| CFG | 2023/Q4 | 47.65% | ||||||

| SCW (SCANWAY) | 2023/Q4 | -1 028.84% | 53.18% | -1 082.02% | -7381.25% | -7368.13% | ||

Skaner akcji GPW: Znajdź najlepsze spółki. Sam określ kryteria dzięki którym znajdziesz najbardziej atrakcyjne spółki GPW.

* Różnica pomiędzy wartością wskaźnika spółki a medianą wartości w sektorze. Przykładowo wartość wskaźnika spółki wynosiła 2.1, natomiast mediana tej wartości w sektorze wynosi 1.5. Czyli wartość tej kolumny będzie wynosiła 0.6.

** Różnica pomiędzy zmianą wartości spółki a medianą zmian w sektorze. Przykładowo wartość r/r spółki wzrosła o +20%, natomiast mediana tej wartości w sektorze wynosi +5%. Czyli wartość tej kolumny będzie wynosiła +15%.

*** Wyłączając tę opcję wskaźnik jest obliczany na podstawie kursu z dnia daty bilansowej raportu finansowego.

Wskaźniki obliczane są na podstawie urocznionych wartości RZiS i PP z 4 ostatnich raportów kwartalnych.

** Różnica pomiędzy zmianą wartości spółki a medianą zmian w sektorze. Przykładowo wartość r/r spółki wzrosła o +20%, natomiast mediana tej wartości w sektorze wynosi +5%. Czyli wartość tej kolumny będzie wynosiła +15%.

*** Wyłączając tę opcję wskaźnik jest obliczany na podstawie kursu z dnia daty bilansowej raportu finansowego.

Wskaźniki obliczane są na podstawie urocznionych wartości RZiS i PP z 4 ostatnich raportów kwartalnych.

Wskaźniki prezentują jedynie użyteczne informacje dotyczące kondycji finansowej spółek i nie są rekomendacją w rozumieniu przepisów Rozporządzenia Ministra Finansów z dnia 19 października 2005 r. w sprawie informacji stanowiących rekomendacje dotyczące instrumentów finansowych lub ich emitentów (Dz. U. z 2005 r. Nr 206, poz. 1715).

Biznesradar bez reklam? Sprawdź BR Plus