Biznesradar bez reklam? Sprawdź BR Plus

Sektor NewConnect: Informatyka

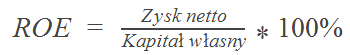

Wskaźniki rentowności: ROE

Zobacz opis wskaźnika

- ROE

ROE (ang. return on equity – stopa zwrotu z kapitału własnego lub rentowność kapitału własnego) – w przedsiębiorczości, wskaźnik rentowności oznaczający jak wiele zysku udało się wygospodarować spółce z wniesionych kapitałów własnych.

Im wartość tego wskaźnika jest wyższa, tym korzystniejsza jest sytuacja firmy. Wyższa efektywność kapitału własnego wiąże się z możliwością uzyskania wyższej nadwyżki finansowej, a co za tym idzie wyższych dywidend.

źródło: Wikipedia, opr. wł.

źródło: Wikipedia, opr. wł.

| Profil | Raport | ROE | r/r | k/k |

|---|---|---|---|---|

| DUA (DUALITY) | 2025/Q4 | 57 000,00% | +75 179,03% | +62 744,25% |

| 7LV (7LEVELS) | 2025/Q4 | 154,32% | -27,12% | -26,61% |

| PRE (PRESIDENT) | 2025/Q3 | 119,56% | -30,12% | |

| PAS (PASSUS) | 2025/Q3 | 102,85% | +319,80% | -9,74% |

| GMV (GAMIVO) | 2025/Q3 | 89,02% | +121,77% | -15,64% |

| YAN (YANOSIK) | 2025/Q3 | 84,47% | +176,68% | -16,25% |

| SWM (SWMANSION) | 2025/Q3 | 56,28% | -11,76% | -8,50% |

| MPS (MEGAPIXEL) | 2025/Q3 | 55,96% | +41,96% | +0,04% |

| TEC (TECNTICA) | 2025/Q3 | 51,28% | -42,77% | -20,53% |

| XPL (XPLUS) | 2025/Q3 | 39,74% | +113,54% | -24,72% |

| SEV (SEVENET) | 2025/Q2 | 39,52% | +1 265,78% | +99,80% |

| CLA (CONSOLE) | 2025/Q3 | 33,01% | +31,57% | -29,53% |

| OXY (OXYGEN) | 2024/Q1 | 30,79% | -97,84% | -43,83% |

| BLO (BLOOBER) | 2025/Q3 | 30,17% | +173,53% | +148,11% |

| MGS (MADNETIC) | 2025/Q3 | 29,64% | -27,01% | +3,56% |

| MAD (MADKOM) | 2025/Q4 | 27,22% | +373,02% | +28,70% |

| SPR (SPYROSOFT) | 2025/Q3 | 26,91% | -0,99% | -6,33% |

| RND (RENDER) | 2025/Q3 | 24,77% | +17,67% | +5,49% |

| VFA (VRFABRIC) | 2025/Q4 | 23,32% | +7 622,58% | +64,11% |

| FRM (FREEMIND) | 2025/Q3 | 21,58% | +220,63% | +48,93% |

| FOR (FOREVEREN) | 2025/Q3 | 20,38% | +31,15% | +45,05% |

| LGT (LGTRADE) | 2025/Q4 | 19,28% | +19,23% | -14,20% |

| EDL (EDITELPL) | 2025/Q4 | 17,51% | +15,81% | -23,57% |

| EXA (EXAMOBILE) | 2025/Q3 | 17,12% | -4,94% | +0,94% |

| PBT (PBGAMES) | 2025/Q4 | 16,32% | -84,55% | -81,56% |

| DGE (DRAGOENT) | 2025/Q3 | 15,46% | -35,82% | -11,71% |

| BTC (BTCSTUDIO) | 2025/Q4 | 14,17% | -69,34% | -67,94% |

| QON (QUARTICON) | 2025/Q3 | 13,17% | -61,70% | -16,22% |

| MLB (MAKOLAB) | 2025/Q4 | 12,61% | -21,33% | -41,73% |

| MMS (MADMIND) | 2025/Q4 | 11,89% | +100,17% | +12,28% |

| SIM (SIMFABRIC) | 2025/Q3 | 9,24% | +117,84% | +233,53% |

| M4B | 2025/Q4 | 8,94% | +480,52% | +148,33% |

| MND (MINERAL) | 2025/Q4 | 8,76% | -67,02% | -73,63% |

| SMT (SIMTERACT) | 2025/Q4 | 7,53% | +73,10% | +142,90% |

| CLD (CLOUD) | 2025/Q3 | 7,39% | -39,77% | -10,96% |

| UFC (UNIFIED) | 2025/Q4 | 6,21% | -49,26% | -62,50% |

| THD (THEDUST) | 2025/Q4 | 5,77% | +100,01% | -96,67% |

| VAR (VARSAV) | 2025/Q4 | 5,70% | +2,15% | +238,69% |

| VEE | 2025/Q4 | 4,50% | +126,12% | +171,43% |

| ECC (ECCGAMES) | 2025/Q3 | 4,47% | +119,40% | +475,63% |

| CWA (CONSOLEW) | 2025/Q3 | 3,41% | +50,22% | -60,53% |

| BTK (BIZTECH) | 2025/Q4 | 2,76% | +178,79% | +54,19% |

| PAC (PROACTA) | 2025/Q4 | 2,72% | +113,01% | +125,93% |

| EFE (EFENERGII) | 2024/Q1 | 2,61% | +103,37% | +472,86% |

| SUN (SUNTECH) | 2025/Q4 | 2,16% | -80,20% | +332,26% |

| SNN (SUNNET) | 2025/Q4 | 1,56% | +189,66% | +394,34% |

| P2C (P2CHILL) | 2025/Q4 | 1,49% | -84,87% | -60,16% |

| FLG (FALCON) | 2024/Q1 | 0,37% | -27,45% | -5,13% |

| JJB (JUJUBEE) | 2025/Q3 | 0,17% | -98,23% | -93,46% |

| EUV (EUVIC) | 2025/Q4 | -0,17% | -102,73% | +98,01% |

| KBJ | 2025/Q4 | -0,93% | -105,16% | -103,79% |

| DDI (DDISTANCE) | 2025/Q4 | -1,16% | +97,09% | +96,39% |

| MOV (MOVIEGAMES) | 2025/Q3 | -2,09% | +88,33% | +90,61% |

| F51 (FARM51) | 2025/Q4 | -2,35% | -119,36% | -126,29% |

| LUK (LUKARDI) | 2025/Q4 | -2,59% | +89,15% | +93,09% |

| END (ENEIDA) | 2025/Q4 | -4,34% | +81,49% | +15,56% |

| IFA (INFRA) | 2025/Q4 | -5,27% | -5 955,56% | -131,14% |

| MLM (MILISYS) | 2025/Q4 | -5,30% | -144,69% | -200,19% |

| THG (TENDERHUT) | 2025/Q3 | -6,54% | +56,63% | +45,00% |

| O2T (ONE2TRIBE) | 2025/Q3 | -7,32% | -20,59% | -21,19% |

| DRG (DRAGEUS) | 2025/Q3 | -7,88% | -767,80% | -540,65% |

| PDG (PYRAMID) | 2025/Q3 | -9,29% | -201,42% | -105,53% |

| CFG | 2025/Q4 | -9,87% | +27,48% | +70,55% |

| LHD (LICHTHUND) | 2025/Q3 | -10,89% | +5,06% | +9,85% |

| WLI (WILDINT) | 2025/Q3 | -11,31% | -20,70% | -47,07% |

| SED (SEDIVIO) | 2025/Q4 | -11,46% | -863,03% | +40,16% |

| RSG (RSGAMES) | 2025/Q4 | -12,53% | +98,33% | +96,08% |

| QUB (QUBICGMS) | 2025/Q3 | -13,97% | -53,85% | -11,14% |

| PRH (POLHOLROZ) | 2025/Q3 | -14,52% | -141,17% | -17,48% |

| STA (STARWARD) | 2025/Q3 | -15,10% | +24,27% | +11,23% |

| MBF (MBFGROUP) | 2025/Q3 | -15,11% | +81,55% | +3,57% |

| DPG (DARKPOINT) | 2025/Q3 | -15,21% | -273,83% | +72,30% |

| WPR (WOODPCKR) | 2025/Q3 | -15,87% | -302,17% | -58,23% |

| PSH (POLYSLASH) | 2023/Q3 | -17,36% | -186,94% | +4,67% |

| NOB (NOOBZ) | 2025/Q4 | -17,37% | +94,84% | +26,43% |

| IMR (INTM) | 2025/Q4 | -18,87% | +7,91% | -455,00% |

| GDS (GDEVS) | 2025/Q4 | -19,31% | -245,19% | +37,91% |

| PPG (PUNCHPUNK) | 2023/Q1 | -20,98% | -80,24% | +10,19% |

| SOK (SONKA) | 2025/Q4 | -21,47% | -142,25% | -117,59% |

| LTM (LTGAMES) | 2025/Q3 | -24,69% | +63,94% | +0,20% |

| TCR (TECHROBOT) | 2025/Q4 | -28,86% | -41,47% | +62,54% |

| PLT (PLOTTWIST) | 2025/Q4 | -29,06% | -41,07% | +21,12% |

| BKD (BKDGAMES) | 2025/Q4 | -31,60% | -946,36% | -221,14% |

| LEG (LEGIMI) | 2025/Q3 | -31,64% | -133,14% | -442,71% |

| IVO (INCUVO) | 2025/Q3 | -32,76% | -61,22% | -22,65% |

| DGS (DEMGAMES) | 2025/Q3 | -34,70% | -272,72% | -40,66% |

| OVI (OVIDWORKS) | 2025/Q4 | -35,73% | -13,25% | -157,05% |

| OML (ONEMORE) | 2025/Q3 | -37,96% | -206,99% | -708,33% |

| ARG (ARTGAMES) | 2025/Q3 | -43,60% | +29,95% | +41,62% |

| PIX (PIXELCROW) | 2024/Q3 | -49,97% | -46,58% | -10,31% |

| EXM (EXIMIT) | 2025/Q3 | -51,39% | -1 092,08% | -28,57% |

| FOX (SPACEFOX) | 2025/Q4 | -54,82% | -100,07% | +2,94% |

| RST (ROAD) | 2025/Q3 | -55,61% | -261,57% | -21,53% |

| YOS (YOSHI) | 2025/Q4 | -60,63% | -51,95% | -173,72% |

| MUN (MUNAR) | 2025/Q4 | -63,80% | -487,48% | -55,65% |

| DFH (DEFENCEH) | 2025/Q4 | -63,96% | -2 753,94% | -727,67% |

| CRB (CARBONSTU) | 2025/Q4 | -67,35% | -165,05% | -69,26% |

| ATJ (ATOMJELLY) | 2025/Q3 | -74,04% | -773,09% | -43,85% |

| TGS (TRUEGS) | 2025/Q3 | -109,92% | -118,66% | -19,66% |

| IWS (IRONWOLF) | 2025/Q3 | -131,80% | -299,64% | +34,15% |

| MLT (MOONLIT) | 2025/Q4 | -137,50% | -186,35% | -213,50% |

| PGG (PROGUNSGR) | 2025/Q3 | -158,45% | +93,06% | -13,72% |

| ICG (ICECODE) | 2025/Q3 | -207,37% | -14 300,69% | +98,51% |

| VAI (VOLARIA) | 2025/Q4 | -207,89% | -160,61% | -57,12% |

| UFG (UFGAMES) | 2025/Q3 | -210,98% | -504,01% | -36,80% |

| EMP (EMPLOCITY) | 2025/Q4 | -238,56% | -205,17% | -55,10% |

| K2P (KOOL2PLAY) | 2025/Q3 | -294,66% | -2 487,01% | +0,92% |

| LMG (LMGAMES) | 2025/Q3 | -423,96% | -112,11% | -110,44% |

| VRF (VRFACTORY) | 2025/Q4 | -593,13% | -444,86% | +38,84% |

| IPW (IMAGEPWR) | 2025/Q3 | -626,24% | -28,85% | -504,63% |

| IMG (IMMGAMES) | 2025/Q3 | -1 158,77% | -495,16% | -228,74% |

| CHP (CHERRY) | 2025/Q3 | -1 262,51% | -50 807,66% | +13,51% |

| BRP (BLACKROSE) | 2025/Q4 | -2 161,90% | -4 054,30% | -12 699,88% |

| NRS (NEURONE) | 2025/Q4 | -3 900,00% | -9 586,74% | -631,25% |

Wskaźniki prezentują jedynie użyteczne informacje dotyczące kondycji finansowej spółek i nie są rekomendacją w rozumieniu przepisów Rozporządzenia Ministra Finansów z dnia 19 października 2005 r. w sprawie informacji stanowiących rekomendacje dotyczące instrumentów finansowych lub ich emitentów (Dz. U. z 2005 r. Nr 206, poz. 1715).

Biznesradar bez reklam? Sprawdź BR Plus