Biznesradar bez reklam? Sprawdź BR Plus

Akcje GPW

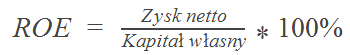

Wskaźniki rentowności: ROE

Zobacz opis wskaźnika

- ROE

ROE (ang. return on equity – stopa zwrotu z kapitału własnego lub rentowność kapitału własnego) – w przedsiębiorczości, wskaźnik rentowności oznaczający jak wiele zysku udało się wygospodarować spółce z wniesionych kapitałów własnych.

Im wartość tego wskaźnika jest wyższa, tym korzystniejsza jest sytuacja firmy. Wyższa efektywność kapitału własnego wiąże się z możliwością uzyskania wyższej nadwyżki finansowej, a co za tym idzie wyższych dywidend.

źródło: Wikipedia, opr. wł.

źródło: Wikipedia, opr. wł.

| Profil | Raport | ROE | r/r | k/k |

|---|---|---|---|---|

| FFI (FASTFIN) | 2023/Q3 | 2 230,00% | +3 444,83% | +5 160,13% |

| REG (REGNON) | 2020/Q1 | 2 150,00% | -77,83% | +353,62% |

| BMC (BUMECH) | 2025/Q3 | 287,13% | +2 719,80% | +7,59% |

| GTN (GETIN) | 2025/Q3 | 180,06% | +137,26% | -12,07% |

| TXT (TEXT) | 2025/Q2 | 166,90% | +0,24% | +83,93% |

| IPO (INTERSPPL) | 2025/Q2 | 125,65% | -39,08% | -28,68% |

| PCO (PEPCO) | 2025/Q4 | 105,14% | +175,72% | |

| PAS (PASSUS) | 2025/Q3 | 102,85% | +319,80% | -9,74% |

| VTL (VISTAL) | 2023/Q3 | 95,84% | -28,25% | -0,81% |

| PUR (PURE) | 2025/Q3 | 92,47% | -76,90% | -4,15% |

| YAN (NEPTIS) | 2025/Q3 | 84,47% | +176,68% | -16,25% |

| IFI (IFIRMA) | 2025/Q3 | 82,13% | +61,04% | +9,80% |

| TOW (TOWERINVT) | 2025/Q3 | 78,11% | +101,09% | +68,38% |

| KSG (KSGAGRO) | 2025/Q3 | 62,84% | +134,44% | +174,65% |

| QRS (QUERCUS) | 2025/Q3 | 61,42% | +34,84% | -4,97% |

| BDX (BUDIMEX) | 2025/Q3 | 59,29% | -14,06% | -17,03% |

| SHO (SHOPER) | 2025/Q3 | 56,39% | +2,29% | -8,20% |

| DIA (DIAG) | 2025/Q3 | 54,23% | +5,55% | -4,89% |

| NXG (NEXITY) | 2025/Q3 | 52,91% | -60,01% | -9,73% |

| DIG (DIGITANET) | 2025/Q3 | 52,62% | +35,30% | -9,07% |

| PTW (PTWP) | 2025/Q3 | 52,56% | +255,38% | +9,84% |

| RBW (RAINBOW) | 2025/Q3 | 51,47% | -18,28% | -32,92% |

| IRL (INTERAOLT) | 2021/Q4 | 51,07% | +4,44% | -52,39% |

| PGV (PGFGROUP) | 2025/Q3 | 48,66% | +199,39% | +123,83% |

| ICE (MEDINICE) | 2025/Q3 | 48,14% | +435,70% | +1,50% |

| GPP (GRUPRACUJ) | 2025/Q3 | 48,05% | -0,17% | -13,58% |

| SCP (SCPFL) | 2025/Q3 | 47,19% | +203,01% | +0,90% |

| SNT (SYNEKTIK) | 2025/Q4 | 46,04% | +5,96% | -2,40% |

| ATR (ATREM) | 2025/Q3 | 44,48% | +27,56% | -5,50% |

| MNC (MENNICA) | 2025/Q3 | 44,10% | +177,53% | +182,15% |

| VOT (VOTUM) | 2025/Q3 | 41,00% | +9,71% | -0,92% |

| XPL (XPLUS) | 2025/Q3 | 39,74% | +113,54% | -24,72% |

| ZAB (ZABKA) | 2025/Q3 | 39,50% | -23,33% | -6,80% |

| SGR (SADOVAYA) | 2016/Q4 | 38,69% | -59,89% | |

| TEN (TSGAMES) | 2025/Q3 | 37,75% | +69,89% | -3,35% |

| OPN (OPONEO.PL) | 2025/Q3 | 36,78% | -12,49% | -4,14% |

| MUR (MURAPOL) | 2025/Q3 | 36,20% | +37,64% | -5,01% |

| XTB | 2025/Q3 | 35,93% | -29,08% | -21,21% |

| DGA | 2025/Q3 | 35,72% | +335,78% | +235,08% |

| ZRE (ZREMB) | 2025/Q3 | 35,47% | +72,86% | -11,41% |

| DOM (DOMDEV) | 2025/Q3 | 34,26% | +9,28% | +3,44% |

| ENT (ENTER) | 2025/Q3 | 34,02% | -33,89% | -40,99% |

| ZMT (ZAMET) | 2025/Q3 | 33,69% | +461,50% | +1 511,96% |

| MAN (MANYDEV) | 2025/Q1 | 33,48% | -30,67% | -9,00% |

| ABS (ASSECOBS) | 2025/Q3 | 33,42% | +8,02% | -5,81% |

| IMC (IMCOMPANY) | 2025/Q3 | 33,26% | +101,70% | -19,76% |

| PLW (PLAYWAY) | 2025/Q3 | 32,96% | -16,68% | -28,69% |

| QNT (QUANTUM) | 2025/Q3 | 32,04% | +98,14% | +2,66% |

| HUG (HUUUGE) | 2025/Q3 | 32,02% | -26,96% | -8,54% |

| MSP (MOSTALPLC) | 2025/Q3 | 31,93% | +119,66% | +21,68% |

| CCC | 2025/Q3 | 30,76% | -23,52% | -9,98% |

| BLO (BLOOBER) | 2025/Q3 | 30,17% | +173,53% | +148,11% |

| KTY (KETY) | 2025/Q3 | 29,65% | +2,42% | -4,82% |

| NWG (NEWAG) | 2025/Q3 | 29,18% | +70,64% | +30,97% |

| SKH (SKARBIEC) | 2025/Q1 | 28,07% | +874,65% | +10,16% |

| EHG (EUROHOLD) | 2025/Q3 | 27,93% | +132,93% | +0,94% |

| SPR (SPYROSOFT) | 2025/Q3 | 26,91% | -0,99% | -6,33% |

| VOX (VOXEL) | 2025/Q3 | 26,81% | -0,85% | -5,20% |

| DVL (DEVELIA) | 2025/Q3 | 26,51% | +11,15% | +6,85% |

| LPP | 2025/Q3 | 25,21% | -30,95% | -32,52% |

| B24 (BRAND24) | 2025/Q3 | 24,79% | +538,76% | -11,94% |

| RND (RENDER) | 2025/Q3 | 24,77% | +17,67% | +5,49% |

| SGN (SYGNITY) | 2025/Q3 | 24,40% | +0,04% | |

| CTS (CITYSERV) | 2025/Q3 | 24,20% | -9,47% | -3,39% |

| ING (INGBSK) | 2025/Q3 | 23,86% | -10,57% | -7,84% |

| BFT (BENEFIT) | 2025/Q3 | 23,54% | -49,83% | +6,61% |

| ULG (ULTGAMES) | 2025/Q3 | 23,38% | +235,38% | +33,52% |

| VRC (VERCOM) | 2025/Q3 | 23,18% | +3,21% | +1,85% |

| GOP (GAMEOPS) | 2025/Q3 | 21,77% | -40,65% | +13,80% |

| KPL (KINOPOL) | 2025/Q3 | 21,59% | -13,98% | -0,09% |

| ARL (ARLEN) | 2024/Q4 | 21,38% | +18,38% | |

| PEO (PEKAO) | 2025/Q3 | 20,48% | -3,21% | -5,14% |

| PZU | 2025/Q3 | 20,34% | +17,10% | +6,10% |

| ALL (AILLERON) | 2025/Q3 | 20,30% | +19,48% | +17,27% |

| LRQ (LARQ) | 2025/Q3 | 20,29% | +614,97% | +60,14% |

| DCR (DECORA) | 2025/Q3 | 20,27% | -17,40% | -5,55% |

| IMS | 2025/Q3 | 19,80% | -13,04% | +1,12% |

| KRU (KRUK) | 2025/Q3 | 19,51% | -27,47% | -11,92% |

| DNP (DINOPL) | 2025/Q3 | 19,48% | -9,35% | -3,23% |

| ART (ARTIFEX) | 2025/Q3 | 19,45% | -38,49% | -12,74% |

| ALR (ALIOR) | 2025/Q3 | 18,87% | -15,91% | -9,58% |

| PKO (PKOBP) | 2025/Q3 | 18,84% | +26,10% | -2,53% |

| KCH (KRAKCHEM) | 2025/Q3 | 18,82% | -19,43% | -6,55% |

| ASB (ASBIS) | 2025/Q3 | 18,76% | +66,31% | -0,79% |

| CDR (CDPROJEKT) | 2025/Q3 | 18,62% | +8,95% | +17,85% |

| LBW (LUBAWA) | 2025/Q3 | 18,48% | -28,40% | -24,94% |

| SKA (SNIEZKA) | 2025/Q3 | 18,26% | +3,11% | -3,13% |

| TAR (TARCZYNSKI) | 2025/Q3 | 18,22% | -40,40% | +7,30% |

| ELT (ELEKTROTI) | 2025/Q3 | 18,21% | -44,33% | -34,35% |

| GPW | 2025/Q3 | 18,05% | +20,57% | -0,93% |

| TPE (TAURONPE) | 2025/Q3 | 17,96% | +497,35% | +1,70% |

| PLZ (PLAZACNTR) | 2024/Q4 | 17,90% | -40,71% | |

| CAP (CAPITEA) | 2025/Q3 | 17,31% | -72,40% | -24,51% |

| KRK (KRKA) | 2025/Q3 | 17,28% | +4,10% | +13,16% |

| BIP (BIOPLANET) | 2025/Q3 | 17,22% | +220,07% | +20,34% |

| MBK (MBANK) | 2025/Q3 | 17,07% | +111,52% | +3,33% |

| DEK (DEKPOL) | 2025/Q3 | 16,92% | +8,46% | -5,37% |

| EST (ESTAR) | 2024/Q4 | 16,63% | +305,56% | |

| ASE (ASSECOSEE) | 2025/Q3 | 16,61% | -11,03% | -12,53% |

| ECB (ECBSA) | 2025/Q3 | 16,37% | -99,36% | -81,68% |

| BNP (BNPPPL) | 2025/Q3 | 16,14% | +57,31% | -2,48% |

| ETL (EUROTEL) | 2025/Q3 | 16,08% | -16,42% | +4,55% |

| RDN (REDAN) | 2025/Q3 | 15,94% | -83,68% | +5,98% |

| GEA (GRENEVIA) | 2025/Q3 | 15,75% | +90,68% | -0,06% |

| STX (STALEXP) | 2025/Q3 | 15,75% | -1,44% | -14,50% |

| SPL (SANPL) | 2025/Q3 | 15,71% | +0,96% | -6,93% |

| DAD (DADELO) | 2025/Q3 | 15,55% | +43,19% | +14,51% |

| DGE (DRAGOENT) | 2025/Q3 | 15,46% | -35,82% | -11,71% |

| MCR | 2025/Q2 | 15,43% | +7,00% | +210,46% |

| UCG (UNICREDIT) | 2025/Q3 | 15,38% | -7,68% | -0,71% |

| BHW (HANDLOWY) | 2025/Q3 | 15,38% | -18,32% | -6,11% |

| CRJ (CREEPYJAR) | 2025/Q3 | 15,37% | +76,26% | -7,96% |

| TOA (TOYA) | 2025/Q3 | 15,25% | +2,97% | -2,99% |

| APR (AUTOPARTN) | 2025/Q3 | 15,20% | -10,01% | -4,10% |

| NEU (NEUCA) | 2025/Q3 | 15,14% | +3,13% | +17,64% |

| ADV (ADIUVO) | 2025/Q3 | 14,95% | +87,34% | +41,57% |

| ZUK (STAPORKOW) | 2025/Q3 | 14,85% | +540,65% | +7,76% |

| ENP (ENAP) | 2025/Q3 | 14,72% | +254,70% | -18,49% |

| SEL (SELENAFM) | 2025/Q3 | 14,70% | +84,44% | +22,91% |

| SFG (SILVANO) | 2025/Q3 | 14,55% | -21,44% | -4,53% |

| SWG (SECOGROUP) | 2025/Q3 | 14,54% | +26,11% | +51,46% |

| INK (INSTALKRK) | 2025/Q3 | 14,22% | +0,35% | +18,30% |

| LSI (LSISOFT) | 2025/Q3 | 14,18% | +36,35% | -3,34% |

| TOR (TORPOL) | 2025/Q3 | 14,01% | -12,76% | +2,26% |

| FRO (FERRO) | 2025/Q3 | 13,95% | -20,06% | -16,72% |

| WPL (WIRTUALNA) | 2025/Q3 | 13,95% | -13,62% | +3,33% |

| NVT (NOVITA) | 2025/Q3 | 13,94% | -33,65% | -13,31% |

| 4MS (4MASS) | 2025/Q3 | 13,80% | -46,26% | -20,83% |

| LBT (LIBET) | 2025/Q3 | 13,68% | +219,27% | +7,29% |

| EAH (ESOTIQ) | 2025/Q3 | 13,55% | -12,13% | +9,27% |

| ALE (ALLEGRO) | 2025/Q3 | 13,54% | +143,96% | +29,69% |

| CAR (INTERCARS) | 2025/Q3 | 13,49% | -0,74% | +1,20% |

| WTN (WITTCHEN) | 2025/Q3 | 13,43% | -48,39% | -3,52% |

| SON (SONEL) | 2025/Q3 | 13,38% | -19,25% | -23,85% |

| MAK (MAKARONPL) | 2025/Q3 | 13,32% | -27,57% | -15,48% |

| TRK (TRAKCJA) | 2025/Q3 | 13,08% | -41,81% | +28,61% |

| SPH (SOPHARMA) | 2025/Q3 | 12,93% | +28,02% | +13,22% |

| CMP (COMP) | 2025/Q3 | 12,70% | +267,99% | +12,89% |

| KVT (KRVITAMIN) | 2025/Q3 | 12,60% | +832,56% | -15,09% |

| SFS (SFINKS) | 2025/Q3 | 12,21% | +831,14% | -5,13% |

| CBF (CYBERFLKS) | 2025/Q3 | 12,20% | -70,66% | -68,20% |

| MVP (MARVIPOL) | 2025/Q3 | 12,04% | +730,37% | +43,68% |

| INP (INPRO) | 2025/Q3 | 11,96% | +61,62% | +9,22% |

| RHD (REINHOLD) | 2019/Q4 | 11,95% | -89,08% | +231,17% |

| CEZ | 2025/Q3 | 11,85% | +20,67% | +9,72% |

| INL (INTROL) | 2025/Q3 | 11,81% | -29,15% | +8,85% |

| MIL (MILLENNIUM) | 2025/Q3 | 11,67% | +34,76% | +12,32% |

| ODL (ODLEWNIE) | 2025/Q3 | 11,62% | +14,71% | +25,76% |

| ABE (ABPL) | 2025/Q3 | 11,60% | -1,53% | |

| VIN (VINDEXUS) | 2025/Q3 | 11,56% | +149,14% | +5,38% |

| ANR (ANSWEAR) | 2025/Q3 | 11,45% | +255,99% | +43,66% |

| ATP (ATLANTAPL) | 2025/Q1 | 11,45% | -41,25% | -1,63% |

| OBL (ORZBIALY) | 2025/Q3 | 11,44% | -21,75% | -18,05% |

| APT (APATOR) | 2025/Q3 | 11,29% | +52,98% | +4,93% |

| FMG | 2025/Q3 | 11,23% | -46,14% | +85,31% |

| TRR (TERMOREX) | 2025/Q3 | 11,21% | -62,83% | +7,27% |

| MSZ (MOSTALZAB) | 2025/Q3 | 11,16% | -57,70% | -40,10% |

| HEL (HELIO) | 2026/Q1 | 11,12% | -28,49% | +29,30% |

| ACG (ACAUTOGAZ) | 2025/Q3 | 11,02% | -49,79% | -15,10% |

| PCR (PCCROKITA) | 2025/Q3 | 10,88% | +15,87% | +34,65% |

| JWW (JWWINVEST) | 2025/Q3 | 10,87% | +4,42% | +7,09% |

| HRP (HARPER) | 2025/Q3 | 10,81% | +51,19% | |

| ACP (ASSECOPOL) | 2025/Q3 | 10,71% | +11,33% | +1,61% |

| SAN (SANTANDER) | 2023/Q4 | 10,63% | +8,03% | +5,46% |

| ACT (ACTION) | 2025/Q3 | 10,62% | +3,21% | +5,78% |

| 1AT (ATAL) | 2025/Q3 | 10,52% | -55,35% | -17,43% |

| WWL (WAWEL) | 2025/Q3 | 10,39% | +1,96% | +5,38% |

| ATG (ATMGRUPA) | 2025/Q3 | 10,38% | +8,69% | +9,49% |

| MRC (MERCATOR) | 2025/Q3 | 10,29% | +1 230,77% | +47,42% |

| KER (KERNEL) | 2025/Q1 | 10,21% | -38,42% | -10,91% |

| FTE (FORTE) | 2025/Q2 | 10,14% | +692,19% | +27,23% |

| AMB (AMBRA) | 2026/Q1 | 10,08% | -16,07% | -3,26% |

| APL (AMPLI) | 2025/Q3 | 10,08% | -25,99% | +176,92% |

| SEK (SEKO) | 2025/Q3 | 9,78% | -25,11% | +0,72% |

| AST (ASTARTA) | 2025/Q3 | 9,65% | -39,08% | -35,80% |

| BCS (BIGCHEESE) | 2025/Q3 | 9,60% | -65,62% | +3,78% |

| MRB (MIRBUD) | 2025/Q3 | 9,44% | -31,79% | +2,50% |

| FAB (FABRITY) | 2025/Q3 | 9,39% | -67,53% | +2,29% |

| DBC (DEBICA) | 2025/Q3 | 9,30% | -16,74% | +27,92% |

| SIM (SIMFABRIC) | 2025/Q3 | 9,24% | +117,84% | +233,53% |

| JRH | 2025/Q3 | 9,16% | +118,38% | +169,41% |

| MLK (MILKILAND) | 2021/Q1 | 9,09% | -80,63% | |

| DMG (DMGROUP) | 2025/Q3 | 9,02% | -35,94% | -22,58% |

| IMP (IMPERIO) | 2025/Q3 | 8,90% | +183,65% | +900,00% |

| ALI (ALTUS) | 2025/Q3 | 8,83% | +5,88% | -11,43% |

| UNT (UNIMOT) | 2025/Q3 | 8,71% | -78,19% | +63,72% |

| PCX (PCCEXOL) | 2025/Q3 | 8,50% | +41,43% | +7,32% |

| VRG | 2025/Q3 | 8,49% | -4,61% | +1,31% |

| PXM (POLIMEXMS) | 2025/Q3 | 8,46% | +111,53% | +123,31% |

| NTT (NTTSYSTEM) | 2025/Q3 | 8,39% | -33,31% | -7,60% |

| MGT (MANGATA) | 2025/Q3 | 8,38% | +36,48% | +90,89% |

| OTM (OTMUCHOW) | 2025/Q3 | 8,37% | +20,61% | +241,63% |

| SVRS (SILVAIR-REGS) | 2025/Q3 | 8,29% | +144,43% | +28,93% |

| BRS (BORYSZEW) | 2025/Q3 | 7,94% | +550,82% | +46,49% |

| KGH (KGHM) | 2025/Q3 | 7,94% | +172,45% | +7,15% |

| EFK (EFEKT) | 2025/Q3 | 7,75% | -72,59% | -9,99% |

| BST (BEST) | 2025/Q3 | 7,66% | +3,23% | -11,85% |

| OND (ONDE) | 2025/Q3 | 7,55% | -16,20% | +34,82% |

| IPE (IPOPEMA) | 2025/Q3 | 7,55% | -41,06% | +9,90% |

| CLD (CLOUD) | 2025/Q3 | 7,39% | -39,77% | -10,96% |

| UNI (UNIBEP) | 2025/Q3 | 7,31% | +114,92% | +121,52% |

| YRL (YARRL) | 2025/Q3 | 7,27% | -51,66% | -28,37% |

| KGN (KOGENERA) | 2025/Q3 | 7,19% | -14,61% | -2,71% |

| CPI (CPIEUROPE) | 2025/Q2 | 7,02% | +1 532,65% | +111,45% |

| APN (APLISENS) | 2025/Q3 | 7,00% | -31,57% | -7,41% |

| MLG (MLPGROUP) | 2025/Q3 | 6,95% | -1,70% | +15,45% |

| OPL (ORANGEPL) | 2025/Q3 | 6,62% | +13,36% | -4,34% |

| MON (MONNARI) | 2025/Q3 | 6,60% | +2,96% | -6,12% |

| MOL | 2025/Q3 | 6,47% | -41,13% | -10,51% |

| WIK (WIKANA) | 2025/Q3 | 6,42% | -83,19% | -72,76% |

| WAS (WASKO) | 2025/Q3 | 6,35% | -7,70% | +35,68% |

| SNK (SANOK) | 2025/Q3 | 6,00% | -44,60% | -28,32% |

| CSR (CASPAR) | 2025/Q3 | 5,97% | -28,93% | -2,77% |

| EAT (AMREST) | 2025/Q3 | 5,91% | +409,42% | -35,90% |

| FSG (FASING) | 2025/Q3 | 5,76% | -15,42% | +21,78% |

| OPG (ORCOGROUP) | 2025/Q3 | 5,72% | +336,64% | +6,52% |

| ENE (ENELMED) | 2025/Q3 | 5,67% | -56,82% | -32,66% |

| LTX (LENTEX) | 2025/Q3 | 5,65% | -18,12% | +5,41% |

| EDI (EDINVEST) | 2025/Q3 | 5,48% | -56,51% | +52,65% |

| 3RG (3RGAMES) | 2025/Q3 | 5,43% | +80,40% | +412,07% |

| MOJ | 2025/Q3 | 5,37% | -11,39% | -13,25% |

| BOS | 2025/Q3 | 5,32% | +189,13% | +13,92% |

| PAT (PATENTUS) | 2025/Q3 | 5,27% | -82,85% | -36,66% |

| EQU (EQUNICO) | 2025/Q3 | 5,19% | -88,34% | -33,89% |

| IZS (IZOSTAL) | 2025/Q3 | 5,05% | +27,85% | +9,54% |

| PBG | 2025/Q3 | 4,97% | -16,33% | -9,64% |

| PHN | 2025/Q3 | 4,92% | +144,77% | +64,55% |

| ASM (ASMGROUP) | 2025/Q3 | 4,89% | -88,36% | +38,92% |

| LKD (LOKUM) | 2025/Q3 | 4,79% | -80,27% | -31,57% |

| ENA (ENEA) | 2025/Q3 | 4,62% | -60,07% | -24,88% |

| MBW (MBWS) | 2024/Q4 | 4,52% | +5,12% | |

| NVA (PANOVA) | 2025/Q3 | 4,47% | +2,52% | +9,02% |

| PKN (PKNORLEN) | 2025/Q3 | 4,35% | -4,19% | +37,22% |

| ZUE | 2025/Q3 | 4,29% | -51,69% | -2,28% |

| ENG (ENERGA) | 2025/Q3 | 4,12% | +786,67% | +68,85% |

| TLX (TALEX) | 2025/Q3 | 4,04% | -52,08% | +274,07% |

| FEE (FEERUM) | 2025/Q3 | 3,99% | +914,29% | +612,50% |

| ULM (ULMA) | 2025/Q3 | 3,97% | -36,28% | -13,32% |

| RWL (RAWLPLUG) | 2025/Q3 | 3,89% | -34,62% | -2,26% |

| MFO | 2025/Q3 | 3,82% | +463,81% | +13,02% |

| PJP (PJPMAKRUM) | 2025/Q3 | 3,61% | -49,79% | -54,42% |

| MZA (MUZA) | 2025/Q3 | 3,60% | -74,47% | -18,18% |

| LEN (LENA) | 2025/Q3 | 3,55% | -27,70% | +5,03% |

| KDM (KDMSHIPNG) | 2017/Q4 | 3,44% | +112,98% | |

| ENI (ENERGOINS) | 2025/Q3 | 3,19% | +112,95% | +214,34% |

| CDL (CDRL) | 2025/Q3 | 3,06% | -93,67% | +75,86% |

| AGO (AGORA) | 2025/Q3 | 3,02% | +26,36% | +39,17% |

| ARH (ARCHICOM) | 2025/Q3 | 2,96% | -85,32% | -48,52% |

| RPC (ROPCZYCE) | 2025/Q3 | 2,87% | +270,83% | 0,00% |

| AMC (AMICA) | 2025/Q3 | 2,77% | +455,13% | +113,08% |

| TRI (TRITON) | 2025/Q3 | 2,76% | +138,82% | +144,95% |

| BCM (BETACOM) | 2025/Q2 | 2,74% | -64,51% | -43,51% |

| IFC (IFCAPITAL) | 2025/Q1 | 2,65% | +903,03% | +440,82% |

| CPS (CYFRPLSAT) | 2025/Q3 | 2,45% | -41,81% | -31,18% |

| 06N (06MAGNA) | 2025/Q3 | 1,80% | +6,51% | +2,27% |

| CFI | 2025/Q3 | 1,75% | -69,51% | -35,42% |

| KMP (KOMPAP) | 2025/Q3 | 1,69% | -49,70% | -43,29% |

| RMK (REMAK) | 2025/Q3 | 1,67% | -73,49% | -71,60% |

| MBR (MOBRUK) | 2025/Q3 | 1,63% | -94,83% | -94,48% |

| BMX (BIOMAXIMA) | 2025/Q3 | 1,39% | +290,41% | -6,71% |

| DEL (DELKO) | 2026/Q1 | 1,23% | -81,48% | -35,26% |

| GRN (GRODNO) | 2025/Q2 | 0,92% | +107,06% | +105,80% |

| STF (STALPROFI) | 2025/Q3 | 0,87% | -75,14% | -48,21% |

| RNK (RANKPROGR) | 2025/Q3 | 0,84% | -92,31% | +127,63% |

| GOB (GOBARTO) | 2025/Q3 | 0,82% | -80,61% | -65,25% |

| BBD (BBIDEV) | 2025/Q3 | 0,82% | -90,04% | +38,98% |

| IDG (INDYGO) | 2021/Q2 | 0,70% | +300,00% | +14,75% |

| STP (STALPROD) | 2025/Q3 | 0,66% | +167,35% | -10,81% |

| MEX (MEXPOLSKA) | 2025/Q3 | 0,51% | -97,27% | -91,83% |

| MEG (MEGARON) | 2025/Q3 | 0,28% | -88,76% | -90,04% |

| ZEP (ZEPAK) | 2025/Q3 | 0,23% | -99,29% | -93,80% |

| CAV (CAVATINA) | 2025/Q3 | 0,22% | -96,99% | -60,00% |

| STS (SATIS) | 2025/Q3 | 0,15% | -99,85% | +15,38% |

| MCI | 2025/Q3 | 0,08% | -93,65% | -91,40% |

| SNW (SANWIL) | 2025/Q3 | 0,06% | -99,07% | +106,45% |

| IZO (IZOLACJA) | 2025/Q3 | -0,46% | -108,26% | -108,98% |

| BIO (BIOTON) | 2025/Q3 | -0,48% | +50,52% | +72,88% |

| SLV (SELVITA) | 2025/Q3 | -0,91% | -105,33% | -706,67% |

| TRN (TRANSPOL) | 2025/Q3 | -0,96% | -136,64% | -151,61% |

| PBX (PEKABEX) | 2025/Q3 | -0,99% | -115,92% | -120,25% |

| PEP | 2025/Q3 | -1,05% | -112,87% | -208,25% |

| TMR (TATRY) | 2024/Q4 | -1,11% | +26,97% | |

| IFR (IFSA) | 2025/Q1 | -1,27% | -135,38% | -150,00% |

| SKL (SKYLINE) | 2025/Q3 | -1,66% | -106,78% | +5,14% |

| GTC | 2025/Q3 | -1,68% | -131,46% | -196,00% |

| ERG | 2025/Q3 | -1,87% | -243,85% | -41,67% |

| VGO (VIGOPHOTN) | 2025/Q3 | -2,02% | +73,80% | +46,28% |

| MOV (MOVIEGAMES) | 2025/Q3 | -2,09% | +88,33% | +90,61% |

| ATC (ARCTIC) | 2025/Q3 | -2,34% | -118,98% | -588,24% |

| DBE (DBENERGY) | 2025/Q1 | -2,49% | +89,92% | -6 125,00% |

| KOM (KOMPUTRON) | 2025/Q2 | -2,71% | +20,29% | +48,38% |

| ATD (ATENDE) | 2025/Q3 | -2,73% | -173,58% | -562,71% |

| PPS (PEPEES) | 2025/Q3 | -2,94% | +71,95% | -6,14% |

| BOW (BOWIM) | 2025/Q3 | -3,24% | -23,19% | -69,63% |

| KCI | 2025/Q3 | -3,95% | -291,75% | +1,25% |

| RLP (RELPOL) | 2025/Q3 | -4,03% | +4,95% | +40,65% |

| ZAP (PULAWY) | 2025/Q3 | -4,06% | +74,04% | +53,39% |

| IBS (IBSM) | 2025/Q3 | -4,16% | -136,46% | +4,59% |

| AAT (ALTA) | 2025/Q3 | -4,32% | -161,28% | +1,82% |

| CCE (CCENERGY) | 2025/Q3 | -4,34% | -1,64% | -557,58% |

| ALG (AIGAMES) | 2025/Q3 | -4,38% | -115,03% | +39,34% |

| PBF (PBSFINANSE) | 2025/Q3 | -4,46% | -329,90% | -407,59% |

| EUR (EUROCASH) | 2025/Q3 | -4,49% | -232,59% | +12,65% |

| SVE (SNTVERSE) | 2025/Q3 | -4,64% | -218,67% | -541,90% |

| CIG (CIGAMES) | 2025/Q3 | -4,84% | -139,61% | -1 661,29% |

| INC | 2025/Q3 | -4,92% | +92,20% | -4 572,73% |

| CRM (CORMAY) | 2025/Q3 | -4,97% | +58,44% | +34,61% |

| HRS (HERKULES) | 2025/Q3 | -6,36% | +40,56% | +39,14% |

| CRI (CREOTECH) | 2025/Q3 | -6,36% | +75,03% | 0,00% |

| THG (TENDERHUT) | 2025/Q3 | -6,54% | +56,63% | +45,00% |

| MXC (MAXCOM) | 2025/Q3 | -6,72% | -160,47% | +0,74% |

| MIR (MIRACULUM) | 2025/Q3 | -7,20% | +37,12% | +38,72% |

| 11B (11BIT) | 2025/Q3 | -7,43% | -144,12% | -211,56% |

| COG (COGNOR) | 2025/Q3 | -7,44% | -582,57% | +3,00% |

| PWX (POLWAX) | 2025/Q3 | -7,50% | +91,20% | +4,94% |

| TSG (TESGAS) | 2025/Q3 | -7,81% | -323,14% | -39,71% |

| AWM (AIRWAY) | 2025/Q3 | -8,29% | -120,53% | +60,52% |

| BBT (BOOMBIT) | 2025/Q3 | -8,29% | -153,52% | -28,93% |

| CPD (CELTIC) | 2025/Q3 | -8,43% | -105,61% | +97,80% |

| MDI (MDIENERGIA) | 2025/Q3 | -8,51% | +56,09% | +43,53% |

| HDR (HYDROTOR) | 2025/Q3 | -8,75% | -5,80% | +18,53% |

| OPM (OPTEAM) | 2025/Q3 | -9,03% | +73,93% | +70,58% |

| PRI (PRAGMAINK) | 2025/Q3 | -9,37% | -90,84% | -16,54% |

| ECH (ECHO) | 2025/Q3 | -10,31% | -581,78% | +33,44% |

| ERB (ERBUD) | 2025/Q3 | -10,82% | -15,23% | -40,89% |

| KGL | 2025/Q3 | -11,37% | -285,78% | -44,66% |

| CZT (CZTOREBKA) | 2025/Q3 | -11,58% | +45,12% | +42,39% |

| SHD (SOHODEV) | 2024/Q3 | -11,89% | -373,71% | -36,82% |

| 08N (08OCTAVA) | 2025/Q3 | -13,15% | -3,87% | +18,07% |

| IZB (IZOBLOK) | 2025/Q3 | -13,34% | -13,53% | |

| CPL (COMPERIA) | 2025/Q3 | -15,29% | -315,96% | +31,10% |

| IDM (IDMSA) | 2025/Q3 | -15,75% | -159,84% | -113,22% |

| WPR (WOODPCKR) | 2025/Q3 | -15,87% | -302,17% | -58,23% |

| EUC (EUCO) | 2025/Q3 | -16,19% | -308,90% | +5,04% |

| MWT (MWTRADE) | 2025/Q3 | -17,23% | -46,51% | -30,63% |

| UNF (UNFOLD) | 2025/Q3 | -17,43% | +43,81% | +9,78% |

| NTU (NOVATURAS) | 2024/Q4 | -17,46% | -186,91% | +71,42% |

| MSW (MOSTALWAR) | 2025/Q3 | -18,04% | -362,97% | -624,50% |

| SNX (SUNEX) | 2025/Q3 | -18,11% | -47,60% | -2,90% |

| ITB (INTERBUD) | 2025/Q3 | -18,68% | +8,25% | -1,25% |

| PHR (PHARMENA) | 2025/Q3 | -18,95% | +6,28% | -19,41% |

| ATS (ATLANTIS) | 2025/Q1 | -19,94% | -1 618,97% | +22,74% |

| LWB (BOGDANKA) | 2025/Q3 | -21,50% | -126,32% | -98,71% |

| MDG (MEDICALG) | 2025/Q3 | -23,34% | -56,12% | -20,93% |

| DTR (DIGITREE) | 2025/Q3 | -23,77% | -491,29% | +33,27% |

| OTS (OTLOG) | 2025/Q3 | -24,01% | -857,41% | +1,84% |

| URT (URTESTE) | 2025/Q3 | -25,26% | -91,22% | -37,13% |

| FHB (FOODHUB) | 2025/Q3 | -25,73% | -901,17% | -52,61% |

| GKI (IMMOBILE) | 2025/Q3 | -26,84% | -38,21% | +44,11% |

| PGM (PMPG) | 2025/Q3 | -26,86% | -3,03% | +19,05% |

| MOC (MOLECURE) | 2025/Q3 | -27,31% | +41,98% | -1,75% |

| ATT (GRUPAAZOTY) | 2025/Q3 | -27,46% | +32,10% | +4,35% |

| PCE (POLICE) | 2025/Q3 | -28,02% | +82,10% | -13,30% |

| PEN (PHOTON) | 2025/Q3 | -28,85% | -56,37% | -1,09% |

| CLN (CLNPHARMA) | 2025/Q3 | -31,45% | -976,04% | -75,80% |

| PGE | 2025/Q3 | -32,73% | -204,75% | +0,85% |

| GIF (GAMFACTOR) | 2025/Q3 | -34,91% | -48,05% | -25,49% |

| NCL (NOCTILUCA) | 2025/Q3 | -35,16% | +97,37% | +56,02% |

| KPD (KPPD) | 2025/Q3 | -35,99% | -28,77% | +9,00% |

| RNC (REINO) | 2025/Q3 | -41,21% | -3 980,20% | +8,89% |

| GRX (GREENX) | 2024/Q4 | -42,00% | -39,77% | |

| SHG (STARHEDGE) | 2025/Q3 | -42,15% | -665,77% | -12,61% |

| VVD (VIVID) | 2025/Q3 | -43,36% | +48,64% | -18,83% |

| CLC (COLUMBUS) | 2025/Q3 | -44,22% | -189,26% | -113,06% |

| WLT (WIELTON) | 2025/Q3 | -46,98% | -326,70% | +2,69% |

| NTC (NTCAPITAL) | 2025/Q3 | -48,41% | -178,03% | -347,12% |

| MLS (MLSYSTEM) | 2025/Q3 | -48,58% | -188,82% | +17,74% |

| PTG (POLTREG) | 2025/Q3 | -49,64% | -99,04% | -12,92% |

| EEX (EKOEXPORT) | 2024/Q1 | -53,88% | +29,47% | -71,32% |

| BCX (BIOCELTIX) | 2025/Q3 | -54,76% | -44,98% | -22,81% |

| LES (LESS) | 2025/Q3 | -58,12% | -194,27% | -112,72% |

| PRT (PROTEKTOR) | 2025/Q3 | -58,15% | -30,79% | -1,86% |

| JSW | 2025/Q3 | -59,35% | +1,98% | -28,94% |

| NNG (NANOGROUP) | 2025/Q3 | -60,64% | +16,87% | +7,05% |

| CPR (COMPREMUM) | 2025/Q3 | -62,95% | -4 817,97% | -4,64% |

| PRM (PROCHEM) | 2025/Q3 | -73,56% | -58,98% | +21,16% |

| ONO (ONESANO) | 2025/Q3 | -81,61% | -54,21% | -23,18% |

| XTP (XTPL) | 2025/Q3 | -82,62% | +24,87% | +6,92% |

| MAB (MABION) | 2025/Q3 | -84,69% | -1 169,32% | -5,49% |

| QNA (QNATECHNO) | 2025/Q3 | -85,70% | +20,01% | -15,11% |

| GMT (GENOMTEC) | 2025/Q3 | -106,39% | +12,85% | -17,08% |

| TBL (TBULL) | 2025/Q3 | -113,04% | -148,22% | +5,67% |

| WXF (WARIMPEX) | 2025/Q2 | -113,79% | -308,14% | +6,14% |

| RAF (RAFAMET) | 2025/Q3 | -116,82% | -272,16% | -0,46% |

| CTX (CAPTORTX) | 2025/Q3 | -122,36% | -22,24% | -38,86% |

| SEN (SERINUS) | 2025/Q3 | -125,57% | -132,93% | -5,92% |

| CLE (COALENERG) | 2026/Q1 | -130,45% | -817,55% | +19,32% |

| APE (APSENERGY) | 2025/Q3 | -162,53% | -485,48% | +23,78% |

| RVU (RYVU) | 2025/Q3 | -166,65% | -184,43% | -31,67% |

| PCF (PCFGROUP) | 2025/Q3 | -183,03% | -646,45% | -145,22% |

| PKP (PKPCARGO) | 2025/Q3 | -224,24% | -545,67% | +19,51% |

| PMA (PRIMAMODA) | 2023/Q1 | -284,36% | -4 895,28% | -52,85% |

| NVG (NOVAVISGR) | 2025/Q3 | -286,12% | -1 534,04% | -103,07% |

| CPA (CAPITAL) | 2025/Q3 | -334,24% | -35,91% | -49,62% |

| RAE (RAEN) | 2025/Q3 | -365,12% | -1 844,20% | +34,45% |

| DAT (DATAWALK) | 2025/Q3 | -1 176,07% | -197,74% | +44,69% |

| EKP (ELKOP) | 2025/Q2 | -2 966,42% | -8 905,05% | -4 274,61% |

| AGT (AGROTON) | 2023/Q4 |

Wskaźniki prezentują jedynie użyteczne informacje dotyczące kondycji finansowej spółek i nie są rekomendacją w rozumieniu przepisów Rozporządzenia Ministra Finansów z dnia 19 października 2005 r. w sprawie informacji stanowiących rekomendacje dotyczące instrumentów finansowych lub ich emitentów (Dz. U. z 2005 r. Nr 206, poz. 1715).

Biznesradar bez reklam? Sprawdź BR Plus