Biznesradar bez reklam? Sprawdź BR Plus

Komponenty indeksu NCIndex

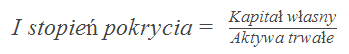

Wskaźniki płynności: I stopień pokrycia

Zobacz opis wskaźnika

- I stopień pokrycia

Wskaźnik jest stosunkiem kapitału własnego przedsiębiorstwa do aktywów trwałych.

Wartość wskaźnika powinna być większa od 0.6, dzięki czemu spółka zapewnia spłatę należności, nawet w razie jej bankructwa.

| Profil | Raport | I stopień pokrycia | r/r | k/k |

|---|---|---|---|---|

| DTX (DITIX) | 2025/Q3 | |||

| ONE (1SOLUTION) | 2025/Q3 | 24,61 | -21,68% | +8,33% |

| KPI (KANCELWEC) | 2025/Q3 | 0,42 | -35,01% | -12,21% |

| KME | 2025/Q3 | 0,85 | +150,96% | -8,63% |

| WRL (WIERZYCL) | 2025/Q3 | 85,70 | +11,86% | +5,28% |

| NWA (NWAI) | 2025/Q3 | 3,70 | +0,84% | -1,57% |

| MFD (MFOOD) | 2025/Q3 | 1,37 | +6,72% | +3,45% |

| CCS | 2025/Q3 | 1,32 | -7,74% | +3,42% |

| ATJ (ATOMJELLY) | 2025/Q3 | 46,35 | -42,54% | -1,64% |

| RSG (RSGAMES) | 2025/Q3 | 5,49 | -85,98% | +0,49% |

| GMV (GAMIVO) | 2025/Q3 | 8,36 | -6,98% | +61,90% |

| LHD (LICHTHUND) | 2025/Q3 | 8,59 | -59,08% | -11,98% |

| GHT (GAMEHUNT) | 2025/Q3 | 88,92 | -86,41% | +16,46% |

| FRW (FROZENWAY) | 2025/Q3 | 22,11 | -7,61% | +10,11% |

| MMS (MADMIND) | 2025/Q3 | 31,61 | +20,96% | +17,07% |

| IMG (IMMGAMES) | 2025/Q3 | 0,54 | -99,96% | -99,85% |

| MGS (MADNETIC) | 2025/Q3 | 3 087,00 | +184,25% | +122,81% |

| ICG (ICECODE) | 2025/Q3 | 0,52 | -2,96% | +7 177,78% |

| PRE (PRESIDENT) | 2025/Q3 | 1 048,73 | +120,14% | |

| CRB (CARBONSTU) | 2025/Q3 | 0,99 | +13,74% | +11,43% |

| CHP (CHERRY) | 2025/Q3 | 0,39 | -54,31% | -3,13% |

| DUA (DUALITY) | 2025/Q3 | 33,75 | +166,16% | +5,47% |

| DFH (DEFENCEH) | 2025/Q3 | 2,33 | +55,53% | +10,19% |

| DPG (DARKPOINT) | 2025/Q3 | 1,08 | +1,35% | +20,41% |

| PLT (PLOTTWIST) | 2025/Q3 | 7,82 | -70,07% | -13,87% |

| STA (STARWARD) | 2025/Q3 | 15,65 | +47,94% | +15,03% |

| JJB (JUJUBEE) | 2025/Q3 | 11,94 | +109,78% | +15,42% |

| RST (ROAD) | 2025/Q3 | 0,68 | -3,51% | -3,71% |

| P2C (P2CHILL) | 2025/Q3 | 95,50 | -10,28% | -11,32% |

| NOB (NOOBZ) | 2025/Q3 | 1,14 | -66,12% | -1,29% |

| CFG | 2025/Q3 | 12,87 | -95,10% | +2,23% |

| ECC (ECCGAMES) | 2025/Q3 | 2 707,50 | +737,43% | -1,10% |

| TGS (TRUEGS) | 2025/Q3 | 0,53 | -32,32% | -8,38% |

| K2P (KOOL2PLAY) | 2025/Q3 | 0,79 | -70,53% | +2,07% |

| SMT (SIMTERACT) | 2025/Q3 | 4,63 | -1,26% | +9,88% |

| FOR (FOREVEREN) | 2025/Q3 | 1,29 | +7,08% | +15,09% |

| MUN (MUNAR) | 2025/Q3 | 55,69 | -17,18% | |

| PDG (PYRAMID) | 2025/Q3 | 127,88 | +410,26% | +151,35% |

| FOX (SPACEFOX) | 2025/Q3 | 40,90 | +2 139,87% | +384,98% |

| SOK (SONKA) | 2025/Q3 | 1,90 | +101,06% | +27,49% |

| FRM (FREEMIND) | 2025/Q3 | 165,11 | -79,87% | +17,85% |

| CWA (CONSOLEW) | 2025/Q3 | 22,33 | +23,03% | +14,72% |

| F51 (FARM51) | 2025/Q3 | 3,17 | +110,98% | +28,41% |

| IWS (IRONWOLF) | 2025/Q3 | 80,91 | -56,84% | +22,59% |

| OVI (OVIDWORKS) | 2025/Q3 | 1,67 | +1 996,82% | +208,08% |

| LTM (LTGAMES) | 2025/Q3 | 212,00 | +4 712,06% | -4,65% |

| WLI (WILDINT) | 2025/Q3 | 1,60 | -95,86% | +10,84% |

| UFG (UFGAMES) | 2025/Q3 | 0,44 | -59,17% | -25,69% |

| GDS (GDEVS) | 2025/Q3 | 32,77 | -91,89% | -9,43% |

| VFA (VRFABRIC) | 2025/Q3 | 3,54 | +67,38% | -30,72% |

| DRG (DRAGEUS) | 2025/Q3 | 23,48 | +11,23% | -13,59% |

| VAR (VARSAV) | 2025/Q3 | 1,09 | -29,29% | -7,91% |

| VRF (VRFACTORY) | 2025/Q3 | 1,02 | -0,77% | -2,12% |

| CLA (CONSOLE) | 2025/Q3 | 19,16 | -3,41% | +7,30% |

| VAI (VOLARIA) | 2025/Q3 | 0,26 | -48,14% | -17,52% |

| QUB (QUBICGMS) | 2025/Q3 | 0,83 | -2,73% | -4,58% |

| OML (ONEMORE) | 2025/Q3 | 0,96 | -42,78% | -9,83% |

| BKD (BKDGAMES) | 2025/Q3 | 100,54 | -18,74% | -6,54% |

| ARG (ARTGAMES) | 2025/Q3 | 22,94 | -21,66% | +26,60% |

| IVO (INCUVO) | 2025/Q3 | 1,97 | +17,15% | +3,29% |

| GAR (GARIN) | 2025/Q3 | 5,96 | ||

| TGG (TRIGGO) | 2025/Q3 | 0,04 | -54,34% | -20,60% |

| VDS (VIDIS) | 2025/Q1 | 1,76 | +2,48% | +6,11% |

| CBD (CANNABIS) | 2025/Q3 | 5,20 | -56,18% | -23,74% |

| TRX (TREX) | 2025/Q3 | 1,44 | -85,24% | +13,57% |

| MNS (MENNICASK) | 2025/Q3 | 11,63 | +7,81% | -0,69% |

| P24 (PRESENT24) | 2025/Q3 | 1,84 | -1,90% | +0,45% |

| OUT (OUTDOORZY) | 2025/Q3 | 36,56 | +21,40% | +25,86% |

| MO2 (MOLIERA2) | 2025/Q3 | 1,45 | -30,45% | -34,21% |

| BIG (BASEIG) | 2025/Q3 | 1,88 | -27,00% | |

| GMZ (GRUPAMZ) | 2025/Q3 | |||

| SFD | 2025/Q3 | 4,02 | +22,26% | +1,10% |

| DKR (DEKTRA) | 2025/Q3 | 2,87 | -45,54% | -33,68% |

| SZR (SZAR) | 2025/Q3 | 1,36 | -30,20% | -23,22% |

| SEV (SEVENET) | 2025/Q1 | 0,35 | +57,09% | -11,54% |

| UNV (UNIVERSE) | 2025/Q3 | 1,64 | -99,43% | -54,90% |

| IFA (INFRA) | 2025/Q3 | 3,30 | -99,41% | -1,62% |

| BTK (BIZTECH) | 2025/Q3 | 2,57 | +11,03% | +4,97% |

| SED (SEDIVIO) | 2025/Q3 | 1,54 | -97,56% | +0,25% |

| LGT (LGTRADE) | 2025/Q3 | 1,48 | -39,55% | -27,67% |

| O2T (ONE2TRIBE) | 2025/Q3 | 0,80 | +2,55% | +1,02% |

| CST (CSTORE) | 2025/Q3 | 1,09 | -3,10% | |

| OPI (OPTIGIS) | 2025/Q3 | 0,38 | -7,05% | -4,81% |

| VRB (VERBICOM) | 2025/Q3 | 3,59 | -4,09% | -1,62% |

| P2B (PLANETB2B) | 2025/Q3 | 4,07 | +7,26% | +1,63% |

| MLB (MAKOLAB) | 2025/Q3 | 11,17 | +41,65% | -1,05% |

| SUN (SUNTECH) | 2025/Q3 | 2,49 | -41,60% | -17,79% |

| MAD (MADKOM) | 2025/Q3 | 0,65 | -0,20% | +12,01% |

| FTH (FINTECH) | 2025/Q3 | 1,77 | +91,58% | -1,85% |

| 4MB (4MOBILITY) | 2025/Q3 | 2,76 | -27,65% | +5,99% |

| PAC (PROACTA) | 2025/Q3 | 1,12 | +3,82% | +3,92% |

| S4E | 2025/Q3 | 0,65 | +10,30% | +9,34% |

| EMP (EMPLOCITY) | 2025/Q3 | 0,58 | +476,47% | +78,05% |

| EXA (EXAMOBILE) | 2025/Q3 | 2,83 | -98,78% | -11,16% |

| KBJ | 2025/Q3 | 2,15 | +27,34% | +0,41% |

| MND (MINERAL) | 2025/Q3 | 2,20 | +55,78% | +5,00% |

| LEG (LEGIMI) | 2025/Q3 | 0,73 | -18,49% | +29,13% |

| EON (EONET) | 2025/Q3 | 1,94 | +21,45% | +36,62% |

| EXM (EXIMIT) | 2025/Q3 | 1,59 | -58,53% | -28,04% |

| SKY (STOHID) | 2025/Q3 | 17,54 | +163,01% | -5,52% |

| VGN (VINCIGEN) | 2025/Q3 | |||

| ARI | 2025/Q3 | 12,86 | +73,74% | -12,62% |

| XDD (MENTZEN) | 2025/Q3 | 0,25 | -75,97% | -11,35% |

| BAC (BACT) | 2025/Q3 | 2,21 | -69,98% | +4,46% |

| LET (LETUS) | 2025/Q3 | 1,17 | +17,85% | +2,15% |

| YOS (YOSHI) | 2025/Q3 | 0,96 | +8,02% | +3,37% |

| MBF (MBFGROUP) | 2025/Q3 | 71,60 | +2 421,22% | +1,00% |

| PLM (POLMAN) | 2025/Q3 | 0,76 | -13,15% | +24,81% |

| DNS (DANKS) | 2025/Q3 | 4,83 | +49,92% | +18,28% |

| GAL (GALVO) | 2025/Q3 | 1,01 | +9,16% | -0,35% |

| RBS (ROBINSON) | 2025/Q3 | 3,46 | -12,03% | +1,58% |

| MLM (MILISYS) | 2025/Q3 | 2,83 | +64,82% | -5,60% |

| GNS (NIEWIADOW) | 2025/Q3 | 1,35 | -50,94% | +49,84% |

| HMP (HEMP) | 2025/Q3 | 2,14 | -46,60% | -9,17% |

| INM (INVENTION) | 2025/Q3 | 0,01 | -87,75% | +67,27% |

| FEM (FEMTECH) | 2025/Q3 | 1,40 | +5 116,07% | -10,11% |

| KLE (KLEPSYDRA) | 2025/Q3 | 0,96 | -12,10% | -2,45% |

| INT (INTERNITY) | 2025/Q3 | 0,65 | +9,10% | +0,09% |

| APS | 2025/Q3 | 3,35 | +129,82% | -1,29% |

| AQA (AQUAPOZ) | 2025/Q3 | 10,23 | +19,01% | +5,38% |

| IDH | 2025/Q3 | 2,98 | +272,72% | -5,74% |

| AZC (AZTEC) | 2025/Q3 | 1,63 | -7,29% | -1,68% |

| TOS (TAMEX) | 2025/Q3 | 3,24 | +12,16% | +10,78% |

| EBX (EKOBOX) | 2025/Q3 | 3,98 | +8,71% | -4,56% |

| ECT (ECO5TECH) | 2025/Q3 | 10,32 | +70,89% | +23,85% |

| MER (MERA) | 2025/Q3 | 1,48 | +13,11% | +1,65% |

| RRH (RRHGROUP) | 2025/Q3 | 1,66 | +60,62% | +12,04% |

| LUG | 2025/Q3 | 0,70 | -13,03% | -14,52% |

| TME (TERMOEXP) | 2025/Q3 | 0,69 | -76,89% | -28,04% |

| CTF (CENTURION) | 2025/Q3 | 9,31 | -20,05% | +22,90% |

| GRM (GREMPCO) | 2025/Q3 | 0,98 | -11,05% | +0,84% |

| EGY (ENERGY) | 2025/Q3 | 60,30 | +2 400,31% | -1,03% |

| BPC | 2025/Q3 | 0,80 | +0,23% | +0,52% |

| SNG (SYNERGA) | 2025/Q3 | 21,00 | -80,34% | -8,70% |

| MDP (MEDCAMP) | 2025/Q3 | |||

| PRH (POLHOLROZ) | 2025/Q3 | 0,79 | +1 180,00% | -4,17% |

| AIN (ABSINVEST) | 2025/Q3 | 13,88 | +177,24% | +148,65% |

| SCS (STEMCELLS) | 2025/Q3 | 0,71 | +20,64% | +2,31% |

| RDG (READGENE) | 2025/Q3 | 0,47 | -15,41% | -7,59% |

| GX1 (GENXONE) | 2025/Q3 | 2,48 | +11,62% | +0,47% |

| GEN (GENOMED) | 2025/Q3 | 3,99 | +22,19% | +18,36% |

| MDB (MEDICOBIO) | 2025/Q3 | 0,49 | -29,38% | -9,87% |

| SBE (SOFTBLUE) | 2025/Q3 | 1,01 | -11,09% | +0,01% |

| TCR (TECHROBOT) | 2025/Q3 | 0,92 | +2 496,60% | -6,24% |

| SYG (SYGNIS) | 2025/Q3 | 0,77 | +22,34% | +12,40% |

| HER (HILANDER) | 2025/Q3 | 0,31 | -22,23% | -10,10% |

| ECL | 2025/Q3 | 1,05 | -20,03% | -1,68% |

| SCW (SCANWAY) | 2025/Q3 | 1,42 | +80,75% | +45,89% |

| PRN (PARTNER) | 2025/Q3 | 0,99 | +0,93% | +0,27% |

| ISD (INSIDPARK) | 2025/Q3 | 8,09 | +314,03% | -15,44% |

| LCN (LABOCANNA) | 2025/Q3 | 0,85 | -22,37% | -1,84% |

| PLI (PLATIGE) | 2025/Q3 | 0,70 | +0,80% | +17,91% |

| GME (GRMEDIA) | 2025/Q3 | 0,80 | -13,06% | -0,40% |

| AVE (ADVERTIGO) | 2025/Q3 | |||

| NTV (NTVSA) | 2025/Q3 | 1,65 | +5,63% | -3,71% |

| BSH | 2025/Q3 | 5,89 | +101,38% | +29,97% |

| NTS (NOTORIA) | 2025/Q3 | 0,80 | -19,73% | -3,85% |

| AOL (ANALIZY) | 2025/Q3 | 2,64 | +41,71% | +19,43% |

| EEE (EKIPA) | 2025/Q3 | 1,64 | -0,06% | -12,03% |

| KUB (KUBOTA) | 2025/Q3 | 22,46 | +20,58% | +17,30% |

| HRT (HURTIMEX) | 2025/Q3 | 0,35 | -39,72% | -11,65% |

| AGL (AGROLIGA) | 2025/Q3 | 0,85 | +0,21% | +11,71% |

| GRZ (GREENZEB) | 2025/Q3 | 0,42 | -67,65% | -36,26% |

| HOR (HORTICO) | 2025/Q3 | 2,81 | +5,74% | -5,45% |

| HPM (HIPROMINE) | 2025/Q3 | 0,22 | +28,71% | +91,52% |

| EXC (EXCELLENC) | 2025/Q3 | 1,89 | +21,02% | +6,25% |

| COS (COSMA) | 2025/Q3 | 0,67 | -31,72% | +0,77% |

| AQU (AQUABB) | 2025/Q3 | 0,93 | -1,60% | -0,88% |

| WOD (WODKAN) | 2025/Q3 | 0,74 | -0,46% | +0,04% |

| MTN (MILTON) | 2025/Q3 | 1,60 | -0,30% | -4,45% |

| SDS (SDSOPTIC) | 2025/Q3 | 0,07 | +107,64% | -42,25% |

| MSM | 2025/Q3 | 2,12 | -19,99% | +6,31% |

| AME (AMESA) | 2025/Q3 | 1,25 | -59,60% | -12,29% |

| CMI | 2025/Q3 | 0,62 | +4,07% | -5,09% |

| NST (NESTMEDIC) | 2025/Q3 | 0,88 | +123,47% | -14,52% |

| EGH (EKOPOL) | 2025/Q3 | 1,73 | +15,54% | +1,83% |

| FVE (FOTOVOLT) | 2025/Q3 | 0,70 | -85,39% | -52,80% |

| VLT (VOOLT) | 2025/Q3 | 1 116,50 | +188,71% | +46,08% |

| OZE (OZECAPITAL) | 2025/Q3 | 1,31 | -11,44% | +25,43% |

| BEE (BEEIN) | 2025/Q3 | 17,65 | -50,17% | -51,78% |

| BEP (BIOMASS) | 2025/Q3 | 2,43 | +7,65% | +2,98% |

| SIN (SOLARINOV) | 2025/Q3 | |||

| GHY (GHYDROGEN) | 2025/Q3 | 0,75 | -8,21% | -1,80% |

| TNT (TNTPROENR) | 2025/Q3 | 0,85 | -2,47% | -0,63% |

| HPE (HIPOWERSA) | 2025/Q3 | 0,98 | +3,53% | -0,63% |

| MIG (MILITARY) | 2025/Q3 | 7,17 | +722,59% | +5,50% |

| COR (COREY) | 2025/Q3 | 0,37 | -30,07% | -12,48% |

| ZEN (ZENERIS) | 2025/Q3 | 3,32 | +16,88% | -6,30% |

| HUB (HUBTECH) | 2025/Q3 | 1,08 | -10,09% | +0,07% |

| NOV (NOVINA) | 2025/Q3 | 1,02 | -27,81% | -7,81% |

| DRF (DRFINANCE) | 2025/Q3 | |||

| MPY (MPAY) | 2025/Q3 | 2,87 | +7,23% | +5,68% |

| IGT (IGORIA) | 2025/Q3 | 1,26 | -11,67% | +1,28% |

| ETX (EUROTAX) | 2025/Q3 | 0,71 | +165,64% | +351,36% |

| PGG (PROGUNSGR) | 2025/Q3 | 0,70 | -49,08% | |

| ADX (ADATEX) | 2025/Q3 | 14,98 | +956,12% | +2,09% |

| VER (MPLVERBUM) | 2025/Q2 | 3,70 | +9,47% | -5,11% |

| OLY (OLYMP) | 2025/Q3 | 0,64 | -38,38% | -6,18% |

| RSP (REMORSOL) | 2025/Q3 | 1,26 | -28,66% | +5,94% |

| KLK (KOLEJKOWO) | 2025/Q3 | 0,75 | +1,73% | +9,24% |

| KOR (KORBANK) | 2025/Q3 | 0,84 | +13,80% | +11,32% |

| VEE | 2025/Q3 | 0,57 | -7,12% | -0,73% |

| TLG (TELGAM) | 2025/Q3 | 0,67 | +6,11% | +2,48% |

| AIT (AITON) | 2025/Q3 | 0,91 | -0,11% | +4,61% |

| TLS (TELESTR) | 2025/Q3 | 1,20 | -31,45% | -1,21% |

| ATA (ATCCARGO) | 2025/Q3 | 3,01 | -19,62% | -2,97% |

| KPC (KUPIEC) | 2025/Q3 | 0,91 | +51,22% | +1,33% |

| PNT (POINTPACK) | 2025/Q3 | 1,13 | +24,30% | +4,72% |

| GRL (GREENLANE) | 2025/Q3 | 0,53 | -19,29% | |

| KLN (KLON) | 2025/Q3 | 0,18 | -56,90% | -51,30% |

| MAZ (MAZOP) | 2025/Q3 | 0,16 | -1,29% | |

| GRC (GRUPAREC) | 2025/Q3 | 0,40 | -8,02% | +4,67% |

| GTS (GEOTRANS) | 2025/Q3 | 1,87 | -7,28% | +2,84% |

| IVE (INVESTEKO) | 2025/Q3 | 0,29 | +1,21% | -1,97% |

| ORL (ORZLOPONY) | 2025/Q3 | 0,33 | -1,36% | +0,37% |

| AUX (AUXILIA) | 2025/Q3 | 0,37 | +5,36% | +4,97% |

Wskaźniki prezentują jedynie użyteczne informacje dotyczące kondycji finansowej spółek i nie są rekomendacją w rozumieniu przepisów Rozporządzenia Ministra Finansów z dnia 19 października 2005 r. w sprawie informacji stanowiących rekomendacje dotyczące instrumentów finansowych lub ich emitentów (Dz. U. z 2005 r. Nr 206, poz. 1715).

Biznesradar bez reklam? Sprawdź BR Plus