Biznesradar bez reklam? Sprawdź BR Plus

Branża Informatyka

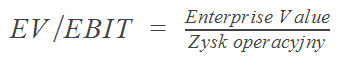

Wskaźniki wartości rynkowej: EV / EBIT

Zobacz opis wskaźnika

- EV / EBIT

Stosunek wartości przedsiębiorstwa do zysku operacyjnego.

Wskaźnik informuje o stopniu pokrycia zysku operacyjnego wartością przedsiębiorstwa. Im mniejsza wartość wskaźnika tym inwestycja może być bardziej atrakcyjna.

| Profil | Raport | EV / EBIT | r/r | k/k |

|---|---|---|---|---|

| PRO (PROMISE) | 2025/Q4 | 115,36 | +5 924,85% | +1 279,62% |

| PAC (PROACTA) | 2025/Q4 | 69,35 | +440,51% | +135,71% |

| BCM (BETACOM) | 2025/Q2 | 46,55 | +354,04% | +231,62% |

| SVRS (SILVAIR-REGS) | 2025/Q3 | 32,09 | +213,69% | -25,56% |

| OPI (OPTIGIS) | 2025/Q3 | 31,93 | +209,21% | -4,04% |

| MAD (MADKOM) | 2025/Q4 | 4,23 | +127,68% | -34,26% |

| B24 (BRAND24) | 2025/Q3 | 38,24 | +123,28% | +5,38% |

| DTR (DIGITREE) | 2025/Q3 | -9,92 | +92,54% | -30,95% |

| SED (SEDIVIO) | 2025/Q4 | -36,65 | +91,42% | -71,88% |

| FAB (FABRITY) | 2025/Q3 | 13,80 | +86,86% | +9,82% |

| MND (MINERAL) | 2025/Q4 | 6,23 | +70,90% | +205,13% |

| P2B (PLANETB2B) | 2025/Q3 | 48,64 | +70,47% | +15,58% |

| TLX (TALEX) | 2025/Q3 | 19,55 | +66,05% | -60,80% |

| DAT (DATAWALK) | 2025/Q3 | -11,98 | +49,93% | +11,73% |

| YRL (YARRL) | 2025/Q3 | 10,91 | +36,76% | +20,87% |

| TXT (TEXT) | 2025/Q2 | 6,48 | +27,55% | +22,70% |

| KBJ | 2025/Q4 | 6,50 | +23,40% | +68,58% |

| ALL (AILLERON) | 2025/Q3 | 7,41 | +13,97% | +10,13% |

| LUK (LUKARDI) | 2025/Q4 | 99,84 | +9,25% | +250,78% |

| EXA (EXAMOBILE) | 2025/Q3 | 6,59 | +8,94% | -7,77% |

| SUN (SUNTECH) | 2025/Q4 | 8,97 | +8,23% | -56,84% |

| SWM (SWMANSION) | 2025/Q3 | 13,59 | +6,02% | +12,08% |

| WAS (WASKO) | 2025/Q3 | 16,11 | +4,10% | -23,81% |

| ACP (ASSECOPOL) | 2025/Q3 | 9,31 | -1,17% | +6,41% |

| BTK (BIZTECH) | 2025/Q4 | 8,56 | -2,99% | -2,48% |

| ASE (ASSECOSEE) | 2025/Q3 | 15,16 | -3,68% | +10,27% |

| GPP (GRUPRACUJ) | 2025/Q3 | 9,46 | -8,06% | +2,18% |

| LGT (LGTRADE) | 2025/Q4 | 7,27 | -10,79% | -21,22% |

| MSFT (MICROSOFT) | 2026/Q2 | 20,80 | -11,01% | -1,58% |

| ABS (ASSECOBS) | 2025/Q3 | 20,79 | -11,71% | -4,29% |

| EDL (EDITELPL) | 2025/Q4 | 13,32 | -14,10% | +6,38% |

| CMP (COMP) | 2025/Q3 | 16,29 | -19,91% | -11,23% |

| VRC (VERCOM) | 2025/Q3 | 26,26 | -20,66% | -2,78% |

| SHO (SHOPER) | 2025/Q3 | 24,25 | -21,62% | -5,42% |

| MLB (MAKOLAB) | 2025/Q4 | 3,58 | -22,17% | +33,12% |

| BPN (BLACKPOIN) | 2025/Q4 | -7,46 | -24,22% | -267,09% |

| NTT (NTTSYSTEM) | 2025/Q3 | 4,82 | -26,04% | -8,92% |

| NVDA (NVIDIA) | 2025/Q3 | 39,96 | -31,87% | -10,74% |

| SPR (SPYROSOFT) | 2025/Q3 | 8,80 | -36,84% | -7,70% |

| XPL (XPLUS) | 2025/Q3 | 19,46 | -38,42% | +37,49% |

| UFC (UNIFIED) | 2025/Q4 | -16,24 | -40,83% | -121,23% |

| AMD (ADVANCED) | 2025/Q4 | 92,80 | -40,93% | -18,77% |

| LSI (LSISOFT) | 2025/Q3 | 9,54 | -44,37% | -1,86% |

| M4B | 2025/Q4 | 26,15 | -47,77% | -30,88% |

| CST (CSTORE) | 2025/Q4 | 16,61 | -50,35% | -38,31% |

| 4MB (4MOBILITY) | 2025/Q4 | 46,40 | -52,35% | +108,06% |

| SAP | 2025/Q4 | 21,08 | -52,48% | -5,45% |

| O2T (ONE2TRIBE) | 2025/Q3 | -43,89 | -52,64% | +68,06% |

| IFI (IFIRMA) | 2025/Q3 | 13,82 | -54,00% | -8,01% |

| YAN (YANOSIK) | 2025/Q3 | 23,83 | -56,13% | -18,56% |

| PAS (PASSUS) | 2025/Q3 | 13,84 | -58,11% | -3,28% |

| BSN (BRAINSCAN) | 2025/Q4 | -7,71 | -61,93% | -18,90% |

| QNT (QUANTUM) | 2025/Q3 | 6,10 | -62,94% | -15,96% |

| S4E | 2025/Q3 | 0,94 | -69,82% | -74,07% |

| PLTR (PALANTIR) | 2025/Q4 | 227,08 | -74,52% | -38,55% |

| SEV (SEVENET) | 2025/Q2 | 8,19 | -94,08% | -65,55% |

| SKY (STOHID) | 2025/Q3 | -55,05 | -99,71% | -27,45% |

| IFA (INFRA) | 2025/Q4 | -55,00 | -112,28% | +60,91% |

| ATD (ATENDE) | 2025/Q3 | -15,67 | -117,59% | +17,98% |

| EXM (EXIMIT) | 2025/Q3 | -13,04 | -129,24% | -26,43% |

| QON (QUARTICON) | 2025/Q3 | -3,35 | -135,38% | -22,95% |

| FTH (FINTECH) | 2025/Q4 | -18,87 | -142,64% | +37,45% |

| WPR (WOODPCKR) | 2025/Q3 | -12,44 | -196,33% | +33,83% |

| EMP (EMPLOCITY) | 2025/Q4 | -1,77 | -202,03% | -2,10% |

| OPM (OPTEAM) | 2025/Q3 | -6,42 | -247,82% | -237,72% |

| VRB (VERBICOM) | 2025/Q4 | -22,39 | -306,36% | -235,40% |

| EUV (EUVIC) | 2025/Q4 | -34,36 | -400,97% | -184,68% |

| INTL (INTEL) | 2025/Q4 | -114,10 | -538,12% | +19,71% |

| PIT (POLARISIT) | 2025/Q4 | -31,69 | -605,15% | |

| LEG (LEGIMI) | 2025/Q3 | -22,44 | -679,05% | +85,63% |

| REG (REGNON) | 2020/Q1 | -14,85 | -6 640,47% | -31,16% |

| STS (SATIS) | 2025/Q3 | -28,02 | -107 241,38% | +20,74% |

| SGN (SYGNITY) | 2025/Q3 | 16,04 | -6,72% |

Wskaźniki prezentują jedynie użyteczne informacje dotyczące kondycji finansowej spółek i nie są rekomendacją w rozumieniu przepisów Rozporządzenia Ministra Finansów z dnia 19 października 2005 r. w sprawie informacji stanowiących rekomendacje dotyczące instrumentów finansowych lub ich emitentów (Dz. U. z 2005 r. Nr 206, poz. 1715).

Biznesradar bez reklam? Sprawdź BR Plus